The Monday Morning Quarterback: A quick analysis of important economic data released over the last week.

The Monday Morning Quarterback: A quick analysis of important economic data released over the last week.

By Elliott D. Pollack and Company

Broader-based measures of economic activity are normally released in the middle of the month. While these are often less interesting than employment and GDP summaries, the information is still useful. Those summary points are included below.

However, the broader story that is being written across the U.S. and in Arizona also needs to be closely followed. Overall, the U.S. economy is growing at a very healthy rate and the growth should continue absent a perfect storm of shocks. Even Congress and the President are unlikely to mess up the economy this year. Some congressional expenditures on Downton Abbey room decorations may have even boosted the economic statistics.

For Arizona, the story is still about jobs and population. Last week’s report on local employment displayed 2.5 percent growth across the state. What is notable is that this was realized without much help from construction and those industries tied to population growth. These latter areas will be improving over the next three years or so. This won’t necessarily be a boom for Arizona, but just simple math reveals that the state’s economic statistics will continue to surprise (except for those that read this letter).

One area of interest for us is how the state’s policymakers deal with promoting the state through economic development efforts. At the present time there are some things we like and some things we do not. What is certain is that the state will be doing business differently. What is less clear is if it will be doing it better or worse. Stay tuned to what efforts take place after session ends.

Arizona Snapshot:

- Retail sales in Arizona were down for the month after the holiday season, but were up 8.9 percent in January from a year ago. In Maricopa County, the increase was 11 percent from a year ago.

- According to CoreLogic, as of the fourth quarter of 2014, 18.8 percent of all residential properties with a mortgage in Greater Phoenix had negative equity. Another 22.5 percent were considered to be “under-equited”. This means that they have less than 20 percent equity in their mortgaged home.

U.S. Snapshot:

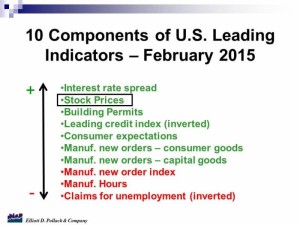

- U.S. Leading Indicators, a group of ten data points, is still moving upward. This is one of those statistics that can accelerate rapidly or slowly depending on what happens in the stock market in a given month. Thus, look for longer term trends. See the chart and table below for the breakdown of the individual components and the longer term trend. Green lettering in the table indicates the index was positively influenced by the statistic, while red lettering indicates the data point pulled the index down.

- Industrial production rebounded 0.1 percent in February after decreasing 0.3 percent in January. Overall, industrial production was supported by a spike in utilities, as especially cold weather drove up demand for heating, but other major components declined. Market expectations were for a 0.3 percent increase.

Overall capacity utilization decreased to 78.9 in February versus 79.1 in January. This is still below levels of capacity that have historically been associated with major increases in spending on plant by business.