The Monday Morning Quarterback/A quick analysis of important economic data released over the past week

The Monday Morning Quarterback/A quick analysis of important economic data released over the past week

By Elliott D. Pollack and Company

The past week’s most prominent data for the U.S. economy include a revision to real GDP, consumer confidence, and inflation measures. For Arizona, the employment forecast was updated and is worth noting.

Arizona Snapshot:

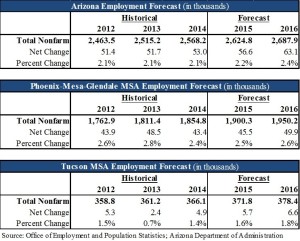

The state is still moving in the right direction and the economic news still tells a consistent story. While the employment forecast is weak by our own historical standards, the forecasted growth has us recovering the jobs lost during the recession (in terms of total count) a little more than a year from now. Keep in mind that this doesn’t equate to full economic recovery. We still need some things to improve in the real estate market and we need to see more people moving to the state before the figures begin to impress. Also, not all jobs are the same. The state needs to also grow in higher wage sectors. Thus, it is a matter of job quantity and quality. The tables below display the state’s recently released employment forecast.

The underlying story for the U.S. economy is for continued growth of between modest and healthy rates for most economic categories. At this point in the cycle the biggest risk to the economy is for multiple “shocks” to occur at the same time. Examples of shocks include a bubble bursting in the stock market, some unanticipated and negative international event, and bad future policy by the Fed, to name just three. The risk of a notable set of unanticipated shocks happening all at the same time is a low probability event, at least at the present time. Since incompetency in D.C. is an anticipated event, this would not qualify as a shock to the economy if there is a temporary government shutdown. The latest data points include:

- Real GDP growth was revised down 2.2 percent in the fourth quarter compared to the advanced estimate of 2.6 percent. However, the GDP revision was better than the summary indicated since the downward revision was in inventory estimates while final sales were revised up. This means additional activity will simply be realized in subsequent quarters.

- Consumer optimism fell in February as both major measures of consumer confidence dipped from January’s spike. The Conference Board index fell 7.4 points to 96.4 from the prior month. While the University of Michigan Consumer Sentiment Index fell to 95.4 from 98.1 in January. Although recent reasons for the lack of optimism are impossible to pin point, severe winter weather through much of the country could, at least for now, be freezing nationwide spirits.

- Overall consumer price inflation fell a sharp 0.7 percent continuing the negative trend at the headline level. This comes after a 0.3 percent decline in December and can be attributed to a drop in energy prices.