ELLIOTT D. POLLACK & Company

FOR IMMEDIATE RELEASE

September 5th, 2017

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

Our thoughts and prayers are with the residents of south Texas and Louisiana who are still grappling with the 1,000-year event of Hurricane Harvey in what is being called one of the worst historical floods in the continental United States. A natural disaster of this magnitude, which is expected to exceed the damage of recent disasters such as Katrina and Sandy, will have numerous impacts on our economy over the next several months. Losses due to uninsured property, automobile damage, curtailing oil and gasoline production, and air traffic suspensions in a metropolitan area that is the fourth largest in the U.S. ranked by GDP will all impact economic conditions, though the extent is still not quantifiable at this point. Some of this will be offset by the rebuilding efforts that will begin to take place.

Compared to the overall trends in the U.S. economy, growth is not expected to be impacted significantly by Hurricane Harvey, but the impacts will likely manifest in the data in the coming weeks and months. Thus, the most recently released data looks positive overall and consistent with previous releases. Job gains were lower in August according to BLS but ADP Research Institute has a much more optimistic estimate and points to historically weak August reports by BLS that are typically revised upward. GDP was revised upward to 3.0% in the second quarter. The ISM manufacturing index shows that the manufacturing sector has expanded for the 12th consecutive month. Additionally, personal income and consumer confidence are on the rise. On the other hand, total sales of autos and light trucks were down again. While the declines have been small, it is still a concern. In other economic news, construction spending was about flat for the month but was still up significantly from a year ago.

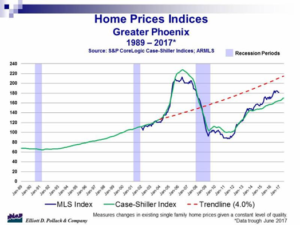

On the local front, the Greater Phoenix Case Shiller Index continued to show improvements. We are still not back to the historical trend line, but heading in the right direction.

U.S. Snapshot:

-

Total nonfarm payroll jobs increased 156,000 in August. Employment increased in health care, manufacturing, construction, professional & technical services, and mining. Employment growth averaged 187,000 in 2016 and has averaged 176,000 year to date and 185,000 over the past three months. June employment figures were revised downward from 231,000 to 210,000 and July’s were revised down from 209,000 to 189,000.

-

The ADP Research Institute’s National Employment Report published much higher estimates of employment growth for the month of August at 237,000 jobs versus only 156,000 jobs reported by the U.S. Bureau of Labor Statistics. They point to a history of weak August jobs reports by BLS that have consistently been revised higher in subsequent months.

-

The unemployment rate rose marginally from 4.3% in July to 4.4% in August. This compares to 4.9% a year ago.

-

The U.S. Bureau of Economic Analysis (BEA) has revised second quarter GDP upward from 2.6% to 3.0%. The increase is thanks to more complete data which showed higher personal consumption expenditures and nonresidential fixed investments.

-

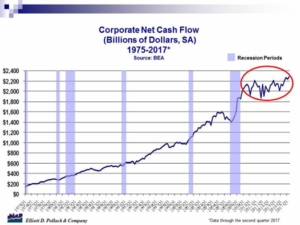

Corporate net cash flow rose 2.4% in the second quarter of 2017 compared to the first quarter. Year over year, corporate net cash flow is up by 8.2% (see chart below).

-

Personal income in the U.S. rose 0.4% between June and July and now stands 2.7% above July 2016. Disposable personal income rose 0.3% for the month and is also 2.7% higher than a year ago. Personal consumption expenditures were up 0.3% for the month in July and were 4.2% above a year ago. As a result, the personal savings rate dropped to 3.5% in July, down from 5.1% a year ago.

-

Consumer confidence rose again in August by 2.9 points to 122.9. The overall level of consumer confidence is at its highest level since March and second highest since 2000. The current level of 122.9 compares to a level of 101.8 just one year ago.

-

The University of Michigan’s consumer sentiment index for August was 96.8 compared to 93.4 in July and 89.8 a year ago.

-

The seasonally adjusted annual rate for total auto and light truck sales in August was down to 16.0 million units from 16.7 million in July and 17.1 million a year ago. This represents a 4.0% drop from the previous month and a 6.4% decline year over year.

-

The ISM’s manufacturing index indicates that the manufacturing sector expanded in August and also helped the consecutive months of growth in manufacturing increase to 12 months. The index increased to 58.8 from July’s 56.3 and now is at its highest level since April 2011. Any reading above 50 indicates expansion.

-

Total construction was slightly lower in July compared to June and now stands 1.8% above year earlier levels, though year to date construction spending is up 4.7% above the same period last year. Private construction was up 4.1% from a year ago while government construction was down 5.6%.

-

Private residential construction was up 0.8% for the month and up 11.6% from a year ago. Single family construction was up 10.4% from a year ago and apartment construction was up 2.6% for the same time period.

-

The S&P/Case-Shiller home price index for June showed that the 20 city composite index was up 0.7% for the month and now stands 5.7% above year earlier levels. Home prices continue their upward trend.

-

The pending home sales index decreased 0.8% to 109.1 in July from 110.0 in June and represents a 1.3% decrease from a year ago. This index has now fallen on an annual basis in three of the last four months. This performance is attributed to the fast pace of sales and the fact that new listings have not kept up.

Arizona Snapshot:

-

The Greater Phoenix S&P/Case-Shiller Home Price Index was up 0.8% in June when compared to May and was up 5.8% from a year ago. While prices have steadily improved, we are still a ways away from our historical trend (see chart below).

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200