ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

October 2nd, 2017

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

The economic data this week was paired with the announcement of the proposed Trump tax policy changes. I won’t go into great detail here on what was proposed because the details will surely change. Suffice it to say that there are a few generalities that are important. First, it is definitely “tax simplification”. The following are the most significant changes.

-

For the average individual, the standard deduction is doubled and the child credit is enhanced. In fact, lower income individuals and moderate income couples will probably pay no income taxes.

-

It reduces the number of brackets from 7 to 3 (or 4).

-

It does away with most deductions except for the mortgage interest and charitable contribution deductions.

-

It does away with many deductions allowed on state taxes. This is significant for the states with the highest property taxes. These tend to be those that have the highest home prices such as California, New York and Connecticut.

-

Finally, despite the rhetoric, the reality is that it would be almost impossible to structure a tax policy that did not in some way lower taxes for the “rich”. There are two reasons for this. The first is what you define as “rich”. Obama’s number was $250,000. I don’t know Trump’s definition. Second, low income people generally don’t pay income taxes. Middle income people don’t pay very high rates. “High” income people pay a disproportionate share of all income taxes. So, it’s tough for them to be excluded regardless of definition.

-

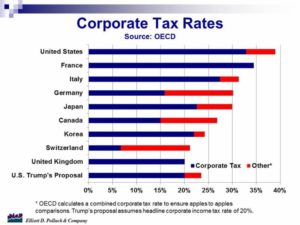

For U.S. corporations, the tax rate will drop from the highest stated tax rate in the industrialized world to a below average rate. Many deductions would also go away. It will make the U.S. more competitive internationally. This is a very big deal. This, along with the opportunity for corporations to bring back billions of dollars to the U.S. at a modest cost.

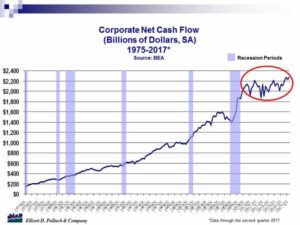

Overall, the results are likely to have certain generalized effects. In the short term, there is likely to be faster growth due to personal and corporate tax cuts, reduced regulation, and infrastructure spending. In the longer term, the effects depend on the extent of the tax cuts, especially the corporate tax cuts. If it causes more investment, chances are that productivity will expand. If it is coupled with a realistic merit based worker visa program, it will increase the rate of growth in the labor force. Both of these would result in higher long term growth rates (including higher incomes and more jobs) for the economy. Other effects on the economy could be higher interest rates, higher inflation, higher after tax corporate cash flows and larger deficits. (The first two are “late in the cycle” norms. The other two are not.) It also will put more pressure on labor markets.

No tax plan is perfect. There are different points of view as to what needs to be accomplished and how. Lobbyists will fight it tooth and nail as it will lower or do away with the value of their industries’ specialized deductions. But, this is long overdue. It is the best chance we will have in years to straighten out what has become a mess that creates significant economic dislocations. It is certainly in the best interests of most Americans to have this dealt with. Hopefully, both sides can start acting more like statesman and stateswomen and create a reasonable (not perfect) solution. Hopefully.

U.S. Snapshot:

-

Real gross domestic product (GDP) increased at an annual rate of 3.1% in the second quarter of 2017. In the first quarter, real GDP increased 1.2%. Real GDP is now 2.2% above year earlier levels. This is the highest level of year over year growth in some time. In addition, the Blue Chip Economic Indicators forecast calls for year over year growth of 2.2% in 2017 and 2.4% in 2018.

-

Corporate profits increased 0.7% in the second quarter of 2017 and now stand 6.3% above year earlier levels.

-

Personal income increased 0.2% in August after a gain of 0.3% in July. Personal income now stands 2.8% above year earlier levels. Disposable personal income for August was up 0.1% over July and is now 2.7% above year earlier levels. Personal consumption expenditures grew by 0.1% in August and are now 3.9% above a year ago. By definition, this caused a decline in the national savings rate which is now 3.6% compared to 4.9% a year ago.

-

Both major measures of consumer confidence fell modestly. The Conference Board measure fell 0.6 to 119.8 in September. Hurricanes could have weighed on the results. The University of Michigan consumer sentiment index fell from 96.8 to 95.1 in September. This is a drop of 1.8%. It followed a 3.6% gain in August. Overall, confidence remains at a high level despite being negatively affected by the hurricanes.

-

Manufacturers’ new orders for durable goods increased 1.7% in August and now stand 5.1% above a year ago.

-

Sales of new single family homes in August stood at 560,000 units (SAAR). This is a 3.4% decline from July and is 1.2% below a year ago.

-

The S&P/Case-Shiller home price index increased 0.7% in July and now stands 5.8% above July 2016. This will continue to build home equity for 75,000,000 American home owners.

Arizona Snapshot:

-

The S&P/Case-Shiller home price index for Greater Phoenix increased 0.6% in July and was 5.6% above July 2016.

-

Enplanements at Sky Harbor International Airport increased 5.4% in August compared to a year ago and deplanements increased 4.2% for the same period. Total air traffic was up 4.8%.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200