Homeowner expected relief from a mortgage deferral, instead got a bill for $4,700: ‘I about fell over’

By Megan Leonhardt | CNBC Utah homeowner Katherine Cwik says she panicked after she found out she owed a lump sum of nearly $4,700 on

By Megan Leonhardt | CNBC Utah homeowner Katherine Cwik says she panicked after she found out she owed a lump sum of nearly $4,700 on

By Catherine Reagor | The Republic Phoenix and Maricopa County have launched renter and mortgage aid programs with a total of $50 million to help residents hurt

By Mary Ann Azevedo | HousingWire This article was written for FinLedger, HW Media’s new fintech-focused news brand designed specifically for financial services professionals in banking, insurance

By Diana Olick | CNBC After a brief pullback at the end of June, homebuyers rushed back into the mortgage market last week, taking advantage

By Mike Sunnucks | Rose Law Group Reporter The regional housing market is seeing demand increase and faces substantial supply constraints as the economy reopens

Builder Mortgage applications increased 0.1% from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending

By Matthew Goldstein and Mary Williams Walsh | New York Times Freedom Mortgage, one of the nation’s largest mortgage lenders, is looking for additional financing as millions

By Jann Swanson | Mortgage Daily News Among responses to the job losses and reduced income already emerging from the COVID-19 pandemic has been a moratorium

By Chris Morris | Fortune As the economic impacts of the coronavirus pandemic begin to hit home, many Americans are worried about how they’ll make their mortgage payments, especially

By Diana Olick | CNBC Mortgage rates have been falling sharply over the last three months, which should be a major positive for the housing

By Brad Hunter | Forbes When mortgage rates went up from the 3%’s to nearly 5% in the second half of 2018, builders felt a

By Adam McCann | Wallethub Buying a home represents an important milestone for most consumers. But for those who dive in to the deep end

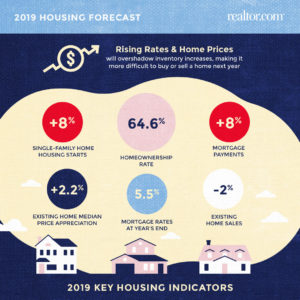

By Holden Lewis | Professional Builder A new ranking reveals 9 challenges, welcome developments, and housing’s most wanted in 2019. While housing inventory and financing is expected to

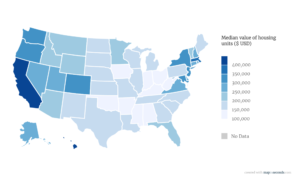

By Emmie Martin | CNBC There are an estimated 76.7 million homeowners in America, according to the U.S. Census Bureau, which recently released its 2013-2017 American Community

REALTOR Magazine Rising mortgage rates and home prices may prove a bigger thorn to home buyers in 2019 as buying a home gets more expensive

By Aaron Terrazas | Zillow Rising mortgage rates will set the scene for the housing market in 2019. They will affect everyone, driving up costs

Among Arizona counties, Cochise and Apache had the highest percentage of property owners with mortgages who owe at least 25 percent more on their

Ten years of BUILDER 100 data reveals top firms’ struggles and successes during one of the industry’s darkest periods. By Jennifer Goodman | Builder A report in

AZBigMedia Phoenix consumers have been longing for more digital solutions in the mortgage space, according to the latest Bank of America Homebuyer Insights Report. Nearly one-third

By Kenneth R. Harney | The Washington Post Call it buried tax treasure for homeowners: Deep inside the behemoth 654-page bipartisan budget bill recently signed into

By Russ Wiles | The Republic The nation’s homeownership rate recently rose on an annual basis for the first time in what seems like forever — the

By Kelsey Ramirez | HousingWire The Dow Jones Industrial Average began decreasing Friday, then plummeted on Monday, seeing its biggest point loss in history. The

By Catherine Reagor | The Republic Thanks to a little boost from mortgage lenders this month, 2018 could be the year all those Street Scout and Zillow couch

Correction: The mortgage amount for the buyer of a $1.2 million home was incorrectly listed as $9,600,000 in the table below. The correct amount is

A strong majority got the mortgages they sought–and put down less than 20%. Builder A strengthening U.S. economy, rising home values and the ongoing stretch

By Laura Kusisto | Realtor.com The down payment has been a big obstacle in recent years for renters looking to buy their first homes. A new mortgage

It’s not just a new lid on MID that may impact demand for for-sale real estate. Fewer may also qualify for a mortgage. By John McManus

Rose Law Group pc values “outrageous client service.” We pride ourselves on hyper-responsiveness to our clients’ needs and an extraordinary record of success in achieving our clients’ goals. We know we get results and our list of outstanding clients speaks to the quality of our work.

(Photo via Gensler, Arizona Coyotes) By Arizona Sports | KTAR Despite the imminent sale and relocation of his team to Salt Lake City, Arizona Coyotes owner Alex Meruelo still plans to bid on and win the

By Angela Gonzales | Phoenix Business Journal A group of investors who own approximately 30,000 acres of land in the Harquahala Valley have inked a

By Jack Healy and Kellen Browning | New York Times Arizona’s highest court on Tuesday upheld an 1864 law that bans nearly all abortions, a decision that could

By Gene Marks | The Hill Have you heard of the Corporate Transparency Act? Apparently, it’s freaking people out. The law was passed as part of

By New York Times The Justice Department will reopen an antitrust investigation into the National Association of Realtors, an influential trade group that has held sway over the residential real estate industry

By MMJ Daily Rose Law Group has announced the return of Ryan Hurley, known as the “Father of Cannabis Law” in Arizona, according to the

Rose Law Group Reporter, which provides Dealmaker’s content and service, is contracted by Rose Law Group. Rose Law Group is a full service real estate and business Law Firm practicing in the areas of land use/entitlements, real estate transactions, real estate due diligence/project management, special districts, tax law, water law, business litigation, corporate formation, intellectual property, asset protection, data breach/privacy law, ADA compliance, estate planning, family law, cyber-law, online reputation and defamation, lobbying, energy and renewable energy, tax credits/financing, employment law, Native American law, equine law, DUIs, and medical marijuana, among others. The views expressed above are not necessarily those of Rose Law Group pc or its associates and are in no way legal advice. This blog should be used for informational purposes only. It does not create an attorney-client relationship with any reader and should not be construed as legal advice. If you need legal advice, please contact an attorney in your community who can assess the specifics of your situation.