A New York-based appeals court has ruled on behalf of a lesbian seeking an estate tax deduction after the death of her spouse in a constitutional challenge to the Defense of Marriage Act.]

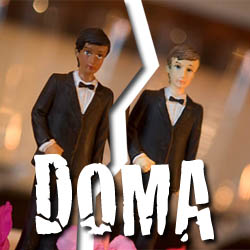

The 2-1 opinion (PDF) by the 2nd U.S. Circuit Court of Appeals struck down a section of DOMA that defines marriage as a union only between one man and one woman for purposes of federal laws and regulations.

“These individual victories are the important steps necessary to achieve the ultimate goal, which is marital equality for everyone, regardless of your sexual orientation,” said Laura Bianchi, Director RLG’s Estate Planning/Asset Protection Department.

The appeals court found a violation of the equal protection clause.

The court ruled on behalf of Edith Windsor of New York, who was assessed more than $363,000 in federal estate taxes because the federal government did not recognize her Canadian marriage.

The 2nd Circuit used intermediate scrutiny to assess the law. According to an ACLU press release, the decision is the first by a federal appeals court to use heightened scrutiny in assessing government discrimination against gays.

If you’d like to discuss estate planning/asset protection, contact Laura Bianchi, Director RLG’s Estate Planning/Asset Protection Department., lbianchi@roselawgroup.com