By Phil Riske | Managing Editor/Rose Law Group Report

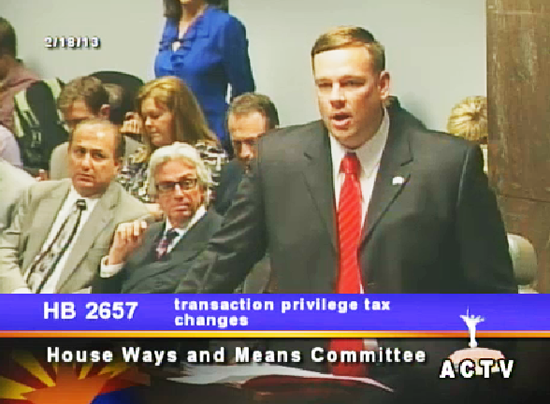

STATE CAPITOL — Monday’s legislative committee hearing on Governor Jan Brewer’s sales tax simplification bill came down to a recurring theme: The devil’s in the details.

The bill was forwarded on an 8-0 vote by the House Committee on Ways and Means, but its fate is far from clear.

Representatives of Valley municipalities who oppose the construction sales tax portion of the bill (HB 2657) testified to what they said would be devastating effects of proposed changes in construction tax policies. Arizona’s cities and towns say they could lose $168 million in the amount of taxes they collect from new construction because sales taxes that now go to municipalities where a project is built could instead be collected where construction materials are actually sold.

The testimony of Surprise Mayor Sharon Wolcott before House Committee on Ways and Means was typical of opposition to the bill. She said her city could not sustain revenue losses from the construction sales tax change.

“I assure you this is not a scare tactic,” she said. “We’re at the bone, adding that after cutting 17 percent of the city’s employees during the recession, Surprise would face cutting police and fire personnel if the bill passes.

Wolcott said the potential revenue from construction-related taxes helps pay for crucial city services, and the bill is worse for bedroom communities that rely on purchases outside city limits.

It’s hard for cities to understand the bill on the fly, Wolcott said, “and now we have an amendment.”

Rep. Javan Mesnard (R- Chandler, Gilbert and Sun Lakes) submitted an amendment regarding alternative retail distribution of the tax. He said the tax payout would be based on actual construction, not population. It does not address local sales taxes. The amendment was adopted on voice vote.

Committee Chairman Rep. Debbie Lesko (R-Glendale) said the bill is misunderstood—it increases state revenue sharing with the cities and towns because the construction portion takes the form of a retail tax.

Arizona’s sales tax system is “messed up,” Lesko said. “We really need to simply our tax system, adding 46 other states have passed similar tax legislation.

She said Arizona would not comply with the proposed federal Market Fairness Act.

The bill also would give Arizona access to Internet sales taxes, said Rep. Bruce Wheeler {D-Tucson).

Lesko and other members of the committee disputed testimony of several mayors their municipalities would be severely hurt by construction tax changes.

Based on increased revenue sharing with the cities and his amendment, Mesnard and Maricopa Mayor Christian Price debated the arithmetic of the construction tax changes.

Price said his city would lose $6 million the first year of new tax policy and $10 million the second year, despite the city having a local construction tax of 3 percent.

“Unless you want to see cities like Maricopa become ghost towns, you should listen to the cities,” Price said.

A few witnesses said they were concerned about auditing under the proposed tax system and noncompliance.

Tom Schoaf, mayor of Litchfield Park, said all 91 cities and towns support seven of the 10 provisions in the bill, but trying to reform construction sales taxes for the different categories of construction isn’t something to have in a tax “simplification” measure.

Victor Perez, deputy director, Department of Revenue (DOR), said there is a 31 percent noncompliance with state sales tax law, down from more than 40 percent.

DOR has been increasing staff and will continue to do so to meet the requirements of the simplification bill, Perez said.

“There’s a whole lot of non-collecting out there . . . [by] bad actors,” said Ferrell Quinlin of the National Federation of Independent Business.

At the end of the near four-hour hearing, it was clear what is bound to be the most debated bill of the session has a long way to go before enactment.

Governor Brewer vetoed a previous sales tax bill because “we didn’t know enough,” Michael Hunter, the governor’s director of policy and one of 22 witnesses, told the committee.

Delay, he said, is a consideration to “make the cities whole.”

“There is work to be done,” said Rep. Gallego, suggesting the construction sales tax maybe should be left out of the bill for now and proceed with other reforms.