On behalf of the Queen Creek Town Council, I’m writing to you today to let you know about a legislative issue that has the potential of greatly affecting our lives in Queen Creek. Governor Brewer has proposed a “tax simplification” structure for the State and local governments. While I agree with the proposal for the most part, there is an area of grave concern from me and the Town Council. The part of the recommendation that changes the way our community collects construction sales tax has some dramatic consequences for Queen Creek House Bill (HB) 2657.

Governor Brewer formed a Transaction Privilege Tax (TPT) Simplification Task Force that has made a number of recommendations that are currently being considered by our legislature. The Council and I support seven of the eight recommendations in the bill, including standardization of the tax base.

Right now, developers pay tax on construction to the community that is experiencing the construction. HB2657 would move collection to the location where materials are purchased. For communities like Queen Creek this means that large homebuilding lumber packages purchased in other areas, or even outside of Arizona, and transported here would no longer be subject to taxes in Queen Creek even though the construction requires the support of city services.

You may have recently seen an editorial in the Arizona Republic expressing their belief that sales tax reform must be fair to Arizona cities. In their article the Editorial Board stated, “Sales-tax simplification is a must for Arizona. But making commerce easier and more efficient should not come at the cost of destabilizing Arizona’s local communities. The Legislature must be sure its reforms don’t starve communities that need construction-industry tax revenue to pay their bills.” I agree with their assessment.

Supporters of modifying the prime contracting system to a point-of-sale approach argue that the change in the system will improve compliance and increase total receipts for the state and local governments. These models are speculative and build only on assumptions of what the Department of Revenue (DOR) believes will occur with the change in tax structure. It is critical that before such a significant change occurs, a thorough economic analysis needs to be performed that accounts for the revenue immediate and long-term revenue. The Legislature is making on a bet of the future fiscal health of the Town Queen Creek without enough analysis.

As a municipality that experienced explosive growth between 2000 and 2010 and is starting to experience permit activity return again, the Town of Queen Creek has relied on prime contracting and construction-related revenue to finance those public infrastructure needs that are not included in the Town’s development impact fees. The Town has a relatively small retail base which results in construction sales currently representing approximately 22% of all sales tax revenue. Because we are a high-growth municipality, the impact on our budget is significantly greater than those local governments that have already been built out, have a significantly higher number of retail businesses or are not experiencing growth.

The Town’s long-term fiscal plan is built on the idea that the needs of new growth are paid for by growth. That is, growth paying for the impacts of growth. In fact, 2% of the Town’s construction sales tax revenue is dedicated to drainage and transportation projects. This is particularly important because the Town can only legally include a limited number of transportation projects included in its development impact fees (only bridges and railroad crossings), and the Town has no transportation projects funded by Proposition 400, the regional half cent sales tax dedicated to transportation for all of Maricopa County.

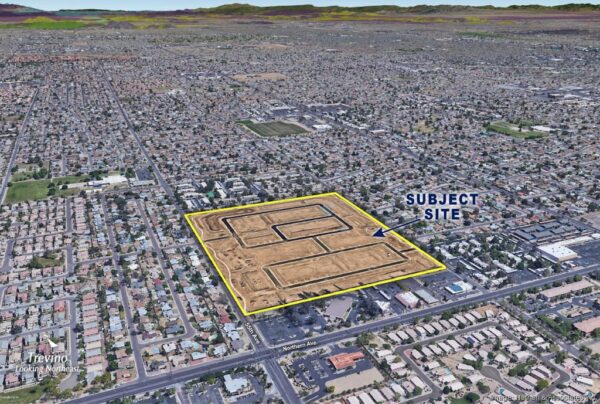

I am is deeply concerned that by changing the Prime Contracting Tax to a point-of-sale tax, many of the revenues generated by the Town related to new home construction will be exported to other cities. A conservative estimate of new home construction in Queen Creek based on permit applications anticipates that there will be approximately 500 new homes built per year over the next five years. This will generate approximately $2.5 million a year in revenue and related expenses for the Town. Again, despite our growth in retail, we are still small and as such we anticipate that the vast majority of this revenue will be lost other communities if the construction tax is changed to a point-of-sale system.

Queen Creek is starting to grow again, and our ability to deliver infrastructure and services to new residents is critically linked to the tax revenue generated by new construction staying in Queen Creek. This does not happen if the state switches to a point of sale calculation. By now, you have seen the types of projects that are funded by these revenues, such as new traffic signals and entirely new roads like the Ellsworth Loop Road.

To protect our philosophy of growth paying for growth, I urge you to contact your legislators now to about your concerns in HB2657 and express your support for our efforts to modify or eliminate this change in the collection of construction sales tax.

Please call or write to the East Valley legislators and let them know that growth needs to pay for growth and that the needs of new residents should not come at the expense of current residents who have paid their fair share.

I sincerely thank you for your attention and consideration of this issue,

/s/ Gail Barney

Mayor, Town of Queen Creek