The Monday Morning Quarterback : A quick analysis of important economic data released over the last week

The craziness continues. Hopefully, by this time next week, there will have been some compromise on the debt ceiling so that default is not an issue. If the debt ceiling is not raised by Thursday, there would still not have to be a default on our debt. But, someone (social security recipients, etc.) would not be happy. In fact, international markets could react violently.

U.S. Snapshot

The Blue Chip consensus forecast calls for year-over-year growth of 1.6% for 2013 and 2.6% for 2014. Thus, the national economy is expected to grow at a modest rate next year. That does not take into account the effects of any debt default that could occur if no agreement on extension of the debt ceiling is reached.

The University of Michigan consumer sentiment index for October shows a slight decline from September and is down 9.0% from a year ago.

Another big rise in student loans and auto loans are behind a large $13.6 billion gain in consumer credit, but, a look at revolving credit shows another decline that points to limited consumer activity. Consumer credit increased at an annual rate of 5.4%

in August. Revolving credit, the component where credit card debt is tracked, is down for the third straight month.

This week, because of the partial shutdown of the government, the following data is not available. Also, computer issues in California have rendered initial claims for unemployment data virtually useless this week.

DATA for U.S. Employment, Motor Vehicle Sales, Construction Spending, Factory Orders NOT AVAILABLE DUE TO GOVERNMENT SHUT DOWN

Arizona Snapshot

Single-family home prices were little changed between July and August. Yet, over the past year, prices are up 28% for single-family homes and 31% for condos.

Foreclosure starts on single-family and condo homes dropped another 5% between July and August and were down 61% from August 2012.

The percentage of residential properties purchased by investors fell from 27% to 23.7% in August. This is down from a peak of 39.7% in July 2012.

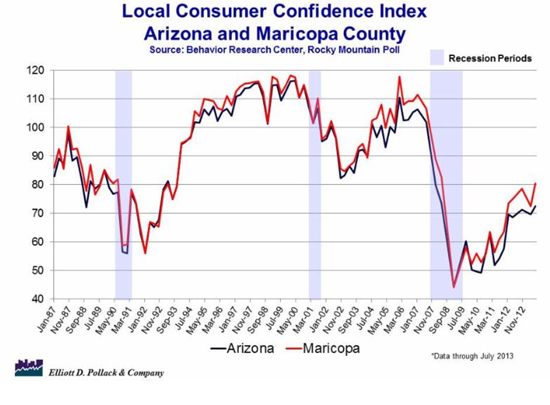

This Week’s Chart

The following chart illustrates how consumers are feeling on a more local level. Though residents of the state and Maricopa County feel much better than all-time lows experienced in 2008/2009, the survey indicates we are still well below historic norms. This consumer confidence data is from Behavior Research Center, and we appreciate their permission to utilize the dataset.