The Monday Morning Quarterback /A quick analysis of important economic data released over the past week

Arizona Snapshot

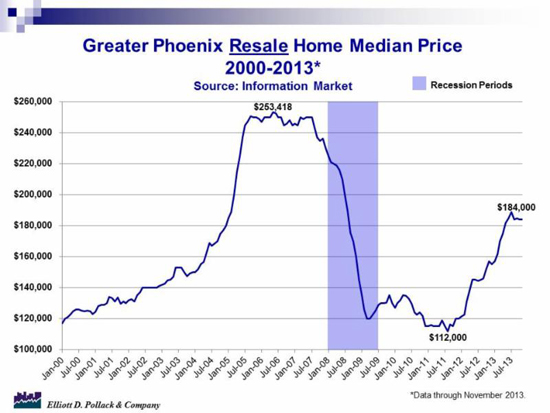

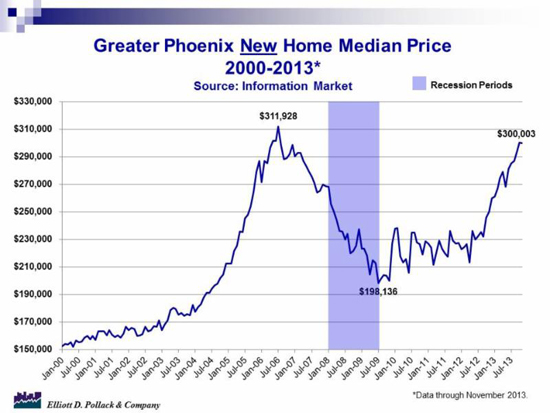

According to the Cromford Report, active listings in the MLS were up in November to 27,049. This is up 16.9% from a year ago and 7.9% from a month ago. The number of units listed is approaching normal. Yet, the higher level of listing combined with a decline in demand (total sales volume is down 18.7% from a year ago) has resulted in median resale prices that have been flat over the last several months. New home sales prices have recovered to nearly peak levels, though sales volume is still quite low.

Report continues below the graphs

Total claims for unemployment insurance continued to decline, suggesting that the state’s unemployment rate should continue to decline in the near term.

Total claims for unemployment insurance continued to decline, suggesting that the state’s unemployment rate should continue to decline in the near term.

Lodging performance statewide was slightly down from a year ago. Occupancy rates were 59.5% in October compared to 59.8% last year. Demand was down while supply was slightly up. For the Phoenix metro area, the picture was better. Occupancy rates were up to 61.3% from 59.6% a year ago in October. Demand increased 2.7% while supply was slightly down.

U.S. Snapshot

Most of the news this week was good. Total payroll jobs in November increased by 203,000. This exceeded expectations and followed a revised 200,000 jobs in October and 175,000 in September. Goods producing jobs increased by 44,000 and private sector service producing jobs gained 152,000 jobs. Government gained 7,000 jobs. While the unemployment rate dropped from 7.3% in October and 7.8% in November of last year, the 7.0% reported still reflects a large number of potential jobs seekers that left the labor force. Thus, the real level of unemployment is understated. Despite the problem with the unemployment rate, the stated number should continue to drop as initial claims for unemployment insurance continue to decline.

The second piece of good news was that real GDP in the third quarter grew at a faster pace (3.6%) than initially thought. Yet, underlying figures suggest slower growth in the final months of the year.

Personal income was down on a month to month basis in October (-0.1%), but, was up 3.4% from a year ago. Disposable personal income was down (-0.2%) as well for the month but still up (2.6%) from a year ago. Personal consumption expenditures (spending) was up for the month (0.3%) and year (2.8%). Thus, the savings rate declined to 4.8% in October from 5.2% in September.

Corporate profits also increased in the third quarter (1.8% from the second quarter) and now stand at a record high.

In other news, new orders for manufactured goods were down for the month. Yet, the ISM manufacturing index was up. The non-manufacturing index was down in November, but, was still above 50. Thus, the sector is still growing. Consumer credit rose sharply (0.6%) in October. While most of the increase was in non-revolving credit (mostly car loans, but, student loans also grew), revolving credit (mostly credit cards) rose as will. In that regard, total auto and light truck sales were up 7.7% over October last month and stand 6.9% over last November. Private sector construction spending was down slightly. New home sales rose to 444,000 in October. This was up substantially from the 354,000 in September.