The Monday Morning Quarterback | A quick analysis of important economic data released over the last week

Elliott D. Pollack & Co.

Welcome to 2014! Most of the recent data looks good. Economists expect the year to be better than 2013, but not as good as a normal recovery. Still, with little irrational exuberance out there, there is little reason not to expect continued growth. So far, the big surprise locally has been the slower than expected recovery in single family housing. This, as we shall discuss in a moment, has to do with the slow rate of population growth in the state and in Greater Phoenix. This is due to a series of factors that are national in scope. Most of these will be resolved over time. But, the near term outlook suggests a better year for housing. The numbers should make homebuilders happy when compared to 2013, but, not when compared to the historic norms.

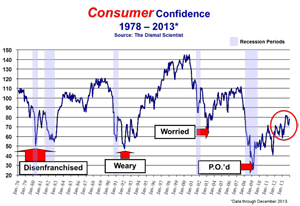

Consumer confidence regarding current conditions was up strongly in December. The Conference board index bounced back to 78.1 compared to 72.0 in November and 66.7 a year ago. The University of Michigan index was also up. The December index was 82.5 compared to 75.1 in November and 72.9 a year ago. The index is now at levels that are relatively normal for the early stages of a recovery (see attached chart).

Auto and light truck sales continued to be strong in November. This seems to be the only major sector of retail where consumers are not being tight fisted. Sales increased about 8% to an annual rate of 16.3 million in November, a pace not seen since 2007.

The manufacturing sector continued to expand in December for the 7th consecutive month and the economy grew for the 55th consecutive month according to the ISM manufacturing index. Of the 18 manufacturing industries, 13 reported growth in December.

Mortgage interest rates were slightly higher for the week of January 2nd. Thirty-year fixed rate mortgages were at 4.53%, up from 4.48% the previous week.

Construction spending was up in November. Private construction was up 12.0% from a year ago while public construction was flat.

Arizona Snapshot

The Census Bureau released population data for the year ending July 1st. It shows what most people already intuitively knew. Population flows are anemic. Arizona population was up 1.2% or 75,475 for the year. Indeed, population flows have been weak for the past 6 years (see attached table). Slow population growth means fewer than normal housing starts. Over time, population will grow again. But, as of now, even though Arizona is the 3rd most popular destination for domestic migrants and 18th for international migrants, the total number of people moving nationally and internationally to the U. S. is about half of what it was at the peak.

Statewide and Metro Phoenix lodging performance improved in November versus a year ago. Occupancy for the state was up to 57.3% compared to 53.8% a year ago. For Metro Phoenix, occupancy was up to 61.6% compared to 57.1% a year ago.

Data from The Cromford Report shows that distressed inventory in Greater Phoenix continues to decline and that the number of new residential foreclosure notices is back to levels not seen since the early 2000’s. This is good news.