The Monday Morning Quarterback: A quick analysis of important economic data released over the past week

U.S. Snapshot

The University of Michigan consumer sentiment index for January declined modestly to 80.4 from 82.5 in December. But, the index is up from 73.8 a year ago.

Money supply, as measured by M2, is now up 5.5% from a year ago. This is still higher than the real growth in the economy plus the rate of inflation. This suggests that real inflation is higher than is being reported or that real growth will be higher. The monetary base, basically cash plus bank reserves, is up a huge 38.9% from a year ago as the Fed continues its quantitative easing (mortgage and bond buying) program. This is not a problem unless the money is loaned out by banks and becomes part of the money supply. Given the slow rate of growth in the economy, this is unlikely at the present time.

Consumer prices, as measured by the consumer price index for all urban consumers, were up 1.5% from a year ago in December. Even the base rate, the CPI less food and energy, was up only 1.7%. This is below the Fed’s target of 2.0%.

Industrial production in the U.S. continued to grow and now stands 3.7% above year earlier levels. This pushed up capacity utilization to 79.2, up from 77.8 a year ago. This is getting close to the level that normally results in business spending more on plant. That would be a good thing as it would stimulate employment.

Inventory/sales ratios for manufacturing and trade held steady at 1.29 in November. This indicates that inventories are in line with sales.

The National Association of Home Builders market index was at 56 in January. This is just about the same as December’s 57 and up from 47 a year ago. In addition, new single family building permits in December were at an annual rate of 610,000. While this is down from 641,000 in November, it is up from 584,000 in December of last year. Single family starts displayed the same pattern-down 7.0% from November, but, up 7.6% from a year ago in December.

(continues below the graphic)

Arizona Snapshot

The latest release from R.L. Brown showed that there were 12,785 single-family building permits issued in Greater Phoenix in 2013. This is up 10.1% from 2012. That made 2013 the best year for permits since 2007. According to R.L.’s data, overall home sales in the region, including both new and existing homes, totaled 101,456 in 2013. This was down 1.3% from 2012’s 102,837 total. Median new home prices ended the year up 20.7%.

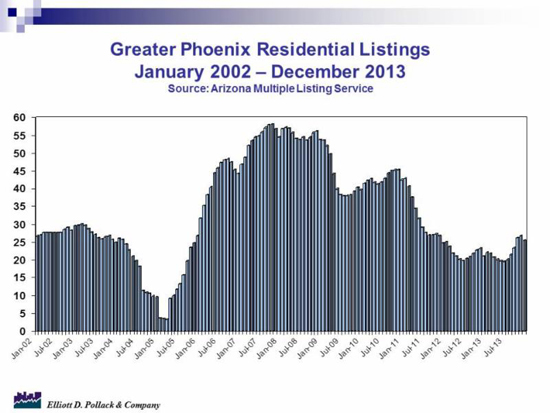

According to the Arizona Regional Multiple Listing Service (ARMLS), the MLS for Greater Phoenix, listings were slightly down for the month but are up about 21% from a year ago. Also, median housing prices, while up 20.9% from a year ago in December, have been relatively flat for the past several months (see chart above).

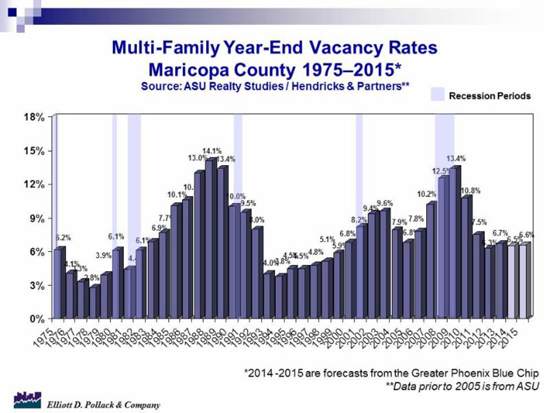

According to Hendricks Berkadia, the outlook for the Greater Phoenix apartment market remains good. Vacancy rates at year-end 2013 were 6.7% (see chart below). The largest drop in rates was among class C properties. Construction was completed on 2,350 units last year. This is up from the 910 completed in 2012. Approximately 4,700 units will be completed in 2014.

According to Cassidy Turley, office vacancy rates in Greater Phoenix reached their lowest since 2008 in 2013. Office vacancy rates were still high, however, at 20.6% at year-end 2013 compared to 25.7% at year-end 2012. Office vacancy rates are expected to drop below 20% by year-end 2014.