The Monday Morning Quarterback : A quick analysis of important economic data released over the past week

The Monday Morning Quarterback : A quick analysis of important economic data released over the past week

Elliott D. Pollack & Co.

This week’s data showed a more mixed picture than has been the case the last several weeks. But, some of the data is likely to be revised as it makes little sense in the context of all the other data being released. So, it would be wise to take a wait and see attitude before judging whether the economy has weakened.

U.S. Snapshot

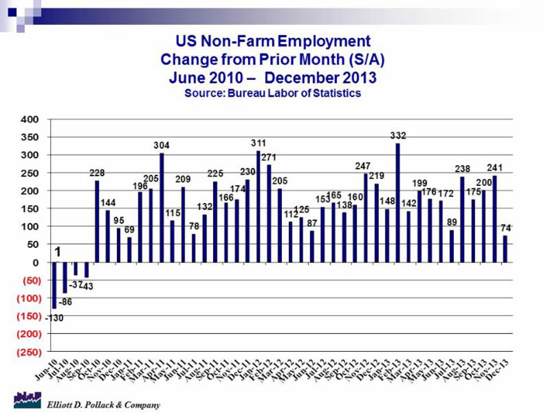

The primary example of this was the employment situation. The net change in nonfarm employment came in at 74,000. This was the weakest monthly showing since January, 2011 (see chart above). It was also way below the expectation of nearly 200,000 jobs. It follows four reasonably strong months of employment reports and (in the context of all the other data released) doesn’t seem to fit. Take a wait and see attitude on this. There seems to be a good chance of upward revisions or a strong January report. If not and the January figure is again weak, then it might be time to reevaluate.

In the same weak jobs report, the unemployment report was issued. The unemployment rate declined to 6.7%. This was better than the 7.0% expected. Unfortunately, the drop was largely the result of people leaving the workforce. Some of the decline in the labor force is due to the aging baby boomer cohort. But, a good part is still due to discouraged workers.

In better news, the Blue Chip Forecast suggests that 2014 should be a better year than 2013. After projected growth of 1.8% in 2013, the panel projects growth of 2.8% in 2014 and 3.0% in 2015.

Consumer credit grew by $12.3 billion (0.4%) in November. This is a solid gain. Revolving credit rose for the second month in a row (up at a 0.6% annual rate) and might indicate that consumers are finished deleveraging for the moment. Non-revolving credit, primarily auto and student loans, were up at a 6.4% annual rate.

Solid domestic demand together with solid foreign markets appears to be giving a lift to the manufacturing sector with factory orders up a very strong 1.8% in November. Another plus was a 0.4% upward revision in October, to -0.5%. September orders were unrevised and very strong at 1.8%.

In addition, the Institute for Supply Management non-manufacturing index indicates that the non-manufacturing sector rose for the 53rd consecutive month in December. The index was 53 vs. 53.9 in November. Any number above 50 indicates growth.

Arizona Snapshot

Arizona total claims for unemployment insurance seems to have plateaued over the last 3 weeks but still remains 18.6% below year earlier levels. This indicates that the state unemployment rate might also have plateaued. Any such plateau should prove to be temporary.

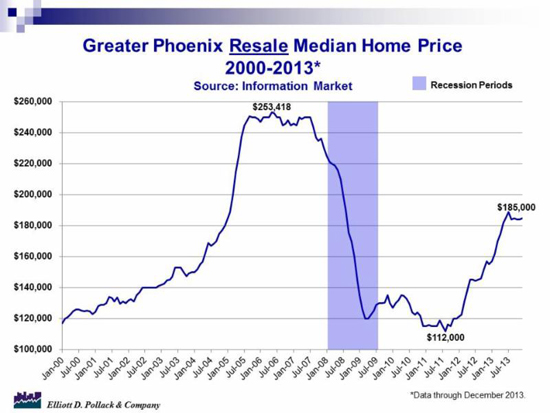

The Cromford Report indicated active listings in Greater Phoenix were slightly down from November. While the total number reported in December is 18.6% above a year ago, this is far from an oversupply. However, this, combined with a slowdown in sales, kept median resale prices stable for the 5th consecutive month (see chart below). Year over year, prices are up 19.3%. The slowdown in demand is primarily a result of a decline in the number of distressed properties on the market that resulted in fewer investor and second home purchases.

New build sales volume was 929 units in December. This is essentially the same as the year earlier level of 928 units.