The Monday Morning Quarterback/ A quick analysis of important economic data released over the last week

The Monday Morning Quarterback/ A quick analysis of important economic data released over the last week

Arizona Snapshot:

Enplanements at Sky Harbor were virtually the same in 2013 as in 2012. Deplanements, though, were down 0.5% for the year. For December, both were up over a year ago. Enplanements were up by 7.1% and deplanements were up by 1.1%.

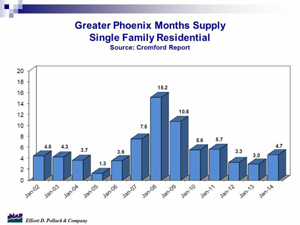

The month’s supply of single-family residential listing in Greater Phoenix stood at 4.7 in January. This compared to 3.0 in January of 2012.

The higher inventory in MLS was accompanied with an 11.2% decline in residential sales activity. The greater supply and lower demand resulted in a continued flattening of resale prices. While resale prices are up 15.7% from a year ago, they have remained flat for the last 8 months. New home prices are up over 20.1% from a year ago.

The overall housing market continues to recover as can be seen by continued declines in distressed residential inventory, new residential foreclosure notices and total pending foreclosure notices.

*****

Just how disconnected the stock market seems to be to new economic information became clear on Friday. After a series of declines supposedly related to a long list of mixed economic signals over the last months, the market increased on what can only be called disappointing employment news. U.S. payrolls gained 113,000 employees in January. Economists had expected a gain of 189,000 according to a Dow Jones survey. This follows a revised gain of just 75,000 workers in December. How much was due to cold weather and how much was a response to strong gains in October and November remains to be seen.

U.S. Snapshot:

The unemployment rate declined to 6.6% from 6.7% in December due to employment gains and only slight gains in the labor force. The underemployment rate was 12.7%.

Productivity increased at a 3.2% annual rate in the 4th quarter of 2013 and now stands 1.7% above a year ago. Unit labor costs, a good measure of cost/push inflation, declined in the 4th quarter and is now 1.3% below a year ago. No pressures here.

According to the ISM’s manufacturing index, the manufacturing sector expanded in January for the eighth consecutive month and the overall economy grew for the 56th consecutive month. The rate of growth in manufacturing was slower, though, as the index stood at 51.3 in January compared to 56.5 in December. Any measure above 50 signifies growth. The non-manufacturing index was at 54.0 compared to 53.0 in December.

Manufacturer’s new orders for durable goods declined in December and now stands only 0.4% above a year ago.

Motor vehicle sales got off to a sluggish start in 2014. Sales fell 0.9% to 15.2 million (SAAR) in January from 15.3 million in December. Many manufacturers blamed frigid temperatures and record snowfall for the poor sales.

Consumer credit surged by $18.8 billion (0.6%) in December. This includes a very large $5.0 billion rise for revolving credit. The revolving credit component has been mostly flat this recovery as consumers continued to pay down revolving (mostly credit card) debt in order to get their financial house in order. The increase was the 3rd largest in this recovery. Non-revolving debt, largely auto and student loans largely reflects the solid pace of motor vehicle sales.