By Robbie Whelan | The Wall Street Journal

By Robbie Whelan | The Wall Street Journal

CBS Corp. last year said it would spin off its billboard business and apply to convert the company to a REIT. Getty Images

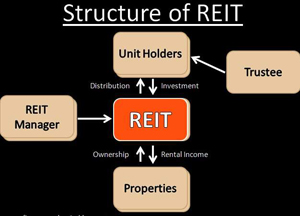

A plan to overhaul the U.S. tax code being floated by Republicans in Congress is rattling the real-estate world because it would limit the type of companies that qualify to become real-estate investment trusts.

Since they were established in 1960, REITs have received favorable tax treatment. They pay no corporate income tax as long as they earn the bulk of their profits from rent and distribute at least 90% of their income to shareholders as dividend payments. Congress created REITs as a way of giving small investors access to the commercial real-estate market and helping landlords diversify their investor base.

Related: Fannie-Freddie Endgame Takes Shape