The Monday Morning Quarterback /A quick analysis of important economic data released over the last week

Employment seems to be the economic story of choice this week. While the data don’t always follow what is initially expected (especially if only looking at one component), the background story is still fairly cohesive. New job creation continues to improve. One threshold to follow is if the U.S. is adding more than 200,000 new jobs each month. Recent data shows we are getting close but we are not quite there. We believe the U.S. should begin trending above this threshold shortly.

Data within this overall growth figure can be confusing. For example, those that postponed retirement due to losses in home equity and stock values are now better positioned to exit the workforce. Alternatively, those wanting to again enter the workforce are finding new opportunities. Some individuals are moving from part time work to full time status, while others have decided they don’t need the second income in the household and aren’t coming back.

These more complex issues pull the economic data in different directions. But, the same background economic story is influencing all of the data; we have been realizing economic growth but it is below what we would hope for nearly five years into the recovery. The next couple of years will see additional economic activity but it is still unclear if we will ever realize the boom that normally occurs following a steep downturn.

Arizona Snapshot:

Weekly claims for unemployment insurance continued to decline modestly but now stand 35.2% below a year ago.

According to the Arizona Regional Multiple Listing Services (ARMLS) Greater Phoenix single-family listings were up 49.3% over a year ago as of March while sales were down 36.0% from a year ago. Median housing prices, while up 14.6% from a year ago in March, are expected to be relatively flat over the upcoming months.

U.S. Snapshot:

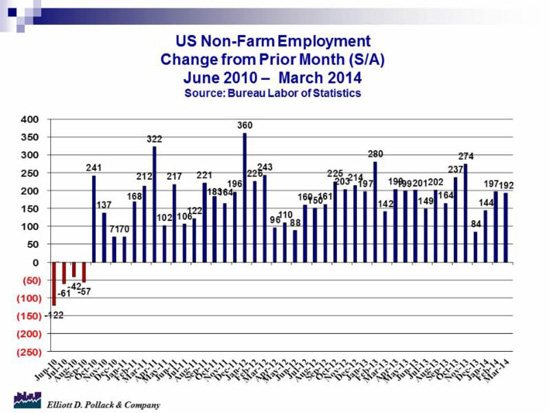

Nonfarm employment increased by a seasonally adjusted 192,000 in March (See chart below.). Both January and February employment was revised upward by a combined 37,000. The unemployment rate held steady at 6.7%.

In March, sales of autos and light trucks were up 6.5% from a year ago to 16.3 million units.

The ISM’s manufacturing index rose to 53.7 in March, up from 53.2 in February. Any reading above 50 indicates that the manufacturing sector is expanding. The same is true for the non-manufacturing index, which rose to 53.1 in March compared to 51.6 in February.

Construction spending remained steady in February but stands 8.7% above year ago levels.