The Monday Morning Quarterback /A quick analysis of important economic data released over the past week

Elliott D. Pollack & Associates

The national economy continues to show slow but steady improvement. The Arizona economy is doing the same with one exception. The local housing market has defied the experts and is having a mediocre year. Without the kick to the economy that a strong new home market would provide, the state and its major metro areas are destined to continue on the current below-par growth path. While the state will continue to create jobs, the rate of growth will be just slightly more than half of what was normal in previous cycles. How soon this changes is a function of how quickly population flows pick up and how soon the 18-34 year old crowd enters the housing market in mass again. The reality is that no one knows for sure. There is some good news on the horizon for housing. The first wave of owners that were foreclosed out of their homes (the big numbers were 2008-2011) will soon pass the 7 year Fannie-Freddie lock out period and will be able to get back into ownership, rather than rental, again.

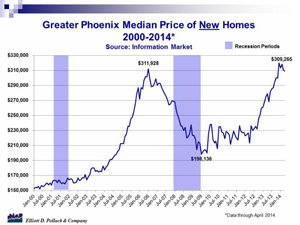

According to the Information Market, total sales volume of residential housing in Greater Phoenix declined 9.2% in April compared to a year ago. Resale volume dropped 9.5% to 7,517 units while new built sales volume dropped 5.8% from a year ago to only 680 units. This was well below expectations and is a clear indication that the weakness in the new home market is not going away soon.

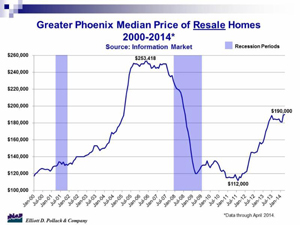

Median resale prices were $190,000 while median new home prices were $309,265 (See charts). Resale prices are a more realistic assessment of prices overall while the new home market is affected more by infill locations now popular with new home builders and the mix of product being built in those more expensive locations.

Average days on market for resale homes was 83 days in April. While the figure was 84 days in March, it was only 70 days in April 2013.

Adverse winter weather hit productivity and unit labor costs in the first quarter. Productivity fell at an annualized 1.7% in the first quarter after a 2.3% advance in the prior quarter. Unit labor costs jumped an annualized 4.2% after declining 0.4% in the 4th quarter of 2013. While these merit watching, they both appear to be temporary.

Economic activity in the non-manufacturing sector grew in April for the 51st consecutive month. The index stood at 55.2 in April compared to 53.1 in March. Any reading of 50 or above signals growth.

Consumer credit in March grew at a 6.7% annual rate and now stands 5.8% above a year ago. The great majority of the increase continues to be in non-revolving credit, mainly auto loans, that now stand 7.8% above a year ago. Revolving credit, mainly credit cards, while up at an annualized rate of 1.6% in March over February are up only 0.9% over a year ago.