Business Real Estate Weekly by Rose Law Group

Phoenix/Tempe – A joint venture formed by Cohen Asset Management Inc. in Los Angeles, Calif. (Brad Cohen, principal) and Intercontinental Real Estate Corp. in Boston, Mass. (Peter Palandjian, CEO) paid $29 million ($166 per foot blended) to buy 174,664 sq. ft. of specialized industrial properties located in Phoenix and Tempe. The sellers in four related but separate transactions were companies formed by Alliance Commercial Partners LLC in Lakewood, Colo. (Richard Stone, et al., partners). The deal was brokered through Will Strong, Andy Markham and Mike Haenel of Cassidy Turley in Phoenix. Public records showBankers Trust Co. In February 2012, BREW reported multiple companies formed by Alliance Commercial Partners paying a combined $18.325 million ($104.92 per foot) to acquire the portfolio of high-tech space. The single tenant properties were developed in 1996 and 1998 and have recently renewed leases in place. The acquisitions were made at a 7 percent cap rate and will be held as long term investments. Continued

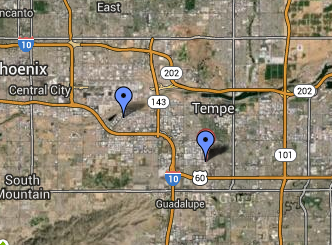

View Cohen Asset Management venture spends $29 million for industrial properties in a larger map

As reported in: