California Gov. Jerry Brown signed a comprehensive state budget today, along with legislation (SB 871) that extends the existing solar property tax exclusion until January 1, 2025. Afterward, Solar Energy Industries Association (SEIA) president and CEO Rhone Resch released the following statement:

California Gov. Jerry Brown signed a comprehensive state budget today, along with legislation (SB 871) that extends the existing solar property tax exclusion until January 1, 2025. Afterward, Solar Energy Industries Association (SEIA) president and CEO Rhone Resch released the following statement:

“SEIA commends Gov. Brown, as well as the California Assembly and Senate, for extending this longstanding, existing state policy, which was initially established through a ballot initiative over 30 years ago. The extension of the exclusion does not take funds away from any jurisdictions where taxes are currently being collected, nor does it have an impact on the General Fund. But the exclusion will reduce wholesale solar electricity costs for utility customers, and it reduces barriers to accessing solar for customer-sited projects. Simply put, many homeowners would not choose to install solar if faced with a property tax reassessment. Just as importantly, this will help achieve the state’s carbon reduction and clean energy goals. We applaud the Governor and lawmakers for their foresight and for their commitment to a clean environment.”

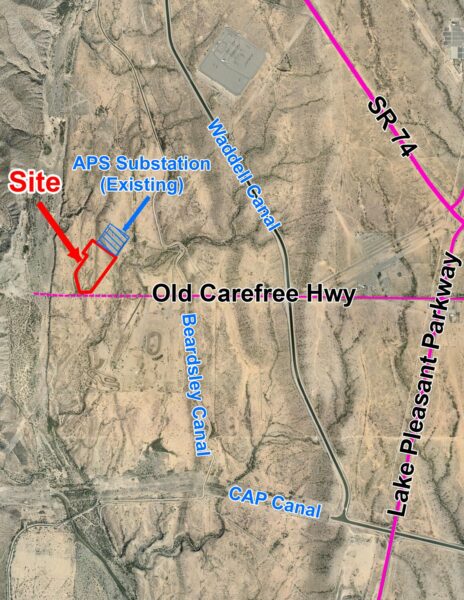

Related: ‘Protect solar energy’ petition delivered to Gov. Jan Brewer’s office today

Solar Manufacturing on the Rebound

Utah Utility Cuts Deal For 20 Years Of Solar Power Because It’s The Cheapest Option

If you’d like to discuss energy issues, contact Court Rich, director of Rose Law Group’s Renewable Energy Department at crich@roselawgroup.com