By Darrell Jackson | The Glendale Star

By Darrell Jackson | The Glendale Star

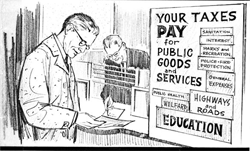

After months of discussions and arguments, Glendale City Council approved the 2-percent increase in the property tax.

The 2 percent is the most allowed by Arizona law.

According to Tom Duensing, executive director of financial services, the primary property tax rate will decrease from $0.4974 per $100 of assessed valuation of fiscal year 2013-14 (FY 13-14) to $0.4896 of assessed valuation for FY 14-15. The secondary property tax rate will decrease from $1.7915 per $100 of assessed valuation for FY13-14 to $1.6605 per $100 of assessed valuation for FY 14-15. The total property tax rate will decrease from $2.2889 to $2.1501.