The Monday Morning Quarterback /A quick analysis of important economic data released over the past week

Elliot D. Pollack & Co.

It was another reasonable week for economic data. The most significant piece of bad news, the downward revision in first quarter 2014 GDP, was expected and was largely explained by the horrible winter weather in that quarter. The result should be a stronger second quarter than would have otherwise taken place. Other than that, the data confirmed a continuation of the slower than normal level of growth. We look for more of the same over the next few months.

Arizona Snapshot

Retail sales in March were up 3.0% for the state and 5.0% for Maricopa County compared to a year ago.

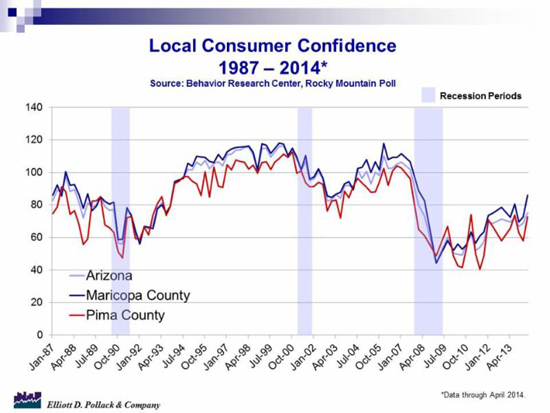

The Rocky Mountain Poll’s Arizona consumer confidence index increased to 75.1 in April, up from 69.6 a year ago and 68.9 in January (see chart below). In Maricopa County, the index stood at 86.1, up from 72.6 a year ago and 72.7 in January. In Pima County, the index was lower at 72.7 but compares to 65.7 a year ago and 58.0 in January.

U.S. Snapshot

Real GDP for the first quarter of 2014 was revised downward from the preliminary number of 0.1% to a revised decline of 1.0%. This can be explained by the bad weather that a large part of the country experienced in that quarter and the resulting downward revisions in inventory investment and experts. The second quarter is likely to be stronger than it normally would be as business plays catch up.

Initial unemployment insurance weekly claims dropped for the week of May 24 to about 300,000. This is 14.3% below year earlier levels. This suggests that the unemployment rate should continue to decline.

Corporate profits declined in the first quarter but remain at a very high level. Corporate cash flows, while modestly down, remain at a very high level.

Manufacturers’ new orders for durable goods in April stand 7.1% above year earlier levels thanks to transportation. New orders were up 0.8% over March levels.

According to the Conference Board, consumer confidence now stands at 83.0. This is the second highest level for this index since early 2008. Yet, according to the University of Michigan survey, confidence, while still high, lags year earlier levels.

Personal income was 3.6% above year earlier levels in April and 0.2% above March levels. Disposable personal income was also up 3.6% over a year ago and 0.3% over March. Personal consumption expenditures were up 4.3% over a year ago because people were saving less. The savings rate declined from 4.6% a year ago to 4.0% in April.