ELLIOTT D. POLLACK & Company

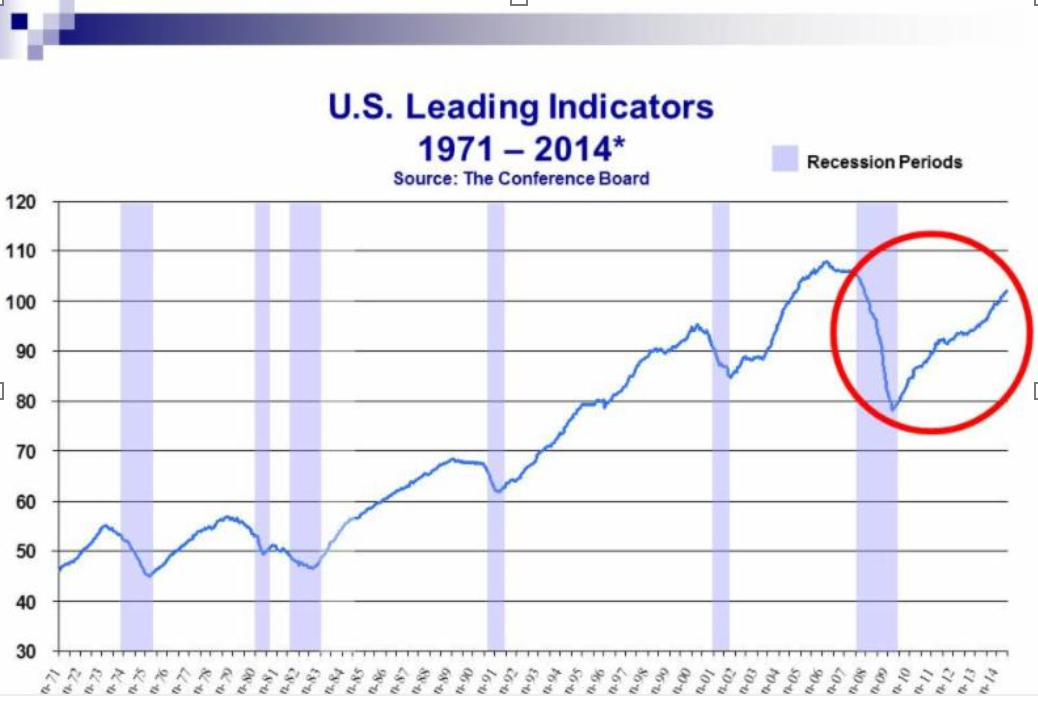

Much of the economic data continues to show positive movement. One measure, the Leading Indicators index, tells an interesting story. The index consolidates ten individual measures of economic activity. Some of the components are adding positively to the index while others are pulling it down. Combining both positive and negative, the index is following an upward trend. This result points to future economic growth.

Looking at the details, six of the ten components are moving upward. Stock prices are still adding to the index value as are the components of manufacturing new orders. Consumer expectations are neutral this month but will likely return to the upward trend shortly. Manufacturing hours and building permits are still negatively impacting the net result. Stock prices are the wild card at the moment. A minor correction (a possible future event) could cause the index to retreat in any given month. This will “signal” weaker economic activity on the horizon. The problem is that stock prices are based on many more things than the core economic data. Look at the longer term trend in this series rather than one individual month (series displayed below).

U.S. Snapshot:

- Preliminary data from the University of Michigan consumer sentiment survey show that consumer confidence declined in July to 81.3, down from 82.5 in June and 85.1 a year ago.

- Industrial production was soft in June slowing to 0.2% growth, following a jump of 0.5% in May. Capacity utilization rate held steady at 79.1.

- In June, retail sales increased 0.2%, following a 0.5% increase in May. Total retail sales now stand 4.3% above a year ago.

Arizona Snapshot:

Arizona employment growth is still sluggish at 1.8% for the first half of the year. The expectation last year at this time was for about 2.5% growth in 2014. To reach 2.5% for the year we would need to grow by about 3.2% during the next six months. This isn’t going to happen. But, if we match last year’s rate of a little more than 2.0% in 2014 we will be fine. Greater Phoenix continues to lead the state while the Tucson area lags a bit. At this point there is more upward potential than downward potential in the state’s economic figures.

- According to Cassidy Turley, the Greater Phoenix office market posted another strong gain in the second quarter of 2014. Due to the increase in demand, the vacancy rate reached its lowest value since 2008, dropping to 19.7%. A year ago the vacancy rate was 22.1%. Office vacancy rates are expected to drop further by year end 2014.

- According to Hendricks Berkadia, developers continue to seek entry into the Greater Phoenix market as multifamily permit activity accelerated 25.4% in the past year. Vacancy rates dropped to 5.9% in the second quarter of 2014, the lowest level since the third quarter of 2006. The outlook for the Greater Phoenix apartment market remains good.

- R.L. Brown reported June single family housing permits in Greater Phoenix were up slightly from May but down 6.8% from a year ago. Year-to-date, permits are down 15.8% (keep in mind that small changes have a big impact on the current base, so don’t make too much of this percentage). Existing home sales declined 8.0% from last June while new home closing increased 7.1% from a year ago.

- In Tucson, Bright Future Real Estate Research reported that single-family permit activity in June rebounded from May to 217 permits. This is up 2.8% from June 2013. Existing home sales increased 3.7% from a year ago. New home closings were up to 184 in June, 33.3% over June 2013.