The Monday Morning Quarterback /A quick analysis of important economic data released over the last week

The Monday Morning Quarterback /A quick analysis of important economic data released over the last week

By Elliott D. Pollack & Co.

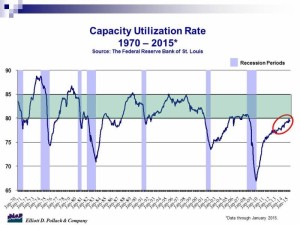

The economic news, for the most part, continues to be good. Leading indicators are up; Monday Morning Quarterback improved; Capacity is not a problem. Yet, new construction remains weak for this point in the cycle. This is true nationally and in Arizona. As we have said before, the economy is as good as it is going to get in the non-construction sectors. That’s why this has been the “non-feel good” recovery. Construction has a long way to go and, indeed, is the major difference between a normal cycle and what is going on now (i.e. reasonable growth but no boom). The full recovery in the housing market is still far off. But, that doesn’t mean that there won’t be improvement over the next couple of years. As construction improves in 2015-2018, things will gradually feel better.

Arizona Snapshot:

- The number of homes listed in the Greater Phoenix multiple listing service was 27,238 in January. This is down from 28,630 a year ago, but, up from 25,052 in December.

- The median sales price of a single family home sold on MLS was $208,900 in January, up from $199,000 a year ago, but, down from $213,000 in December.

- ASU’s monthly real estate report stated that after the lull that started in mid-2013, demand showed its first sign of recovery during December. This growth in demand was particularly strong in the townhouse/condo segment. This could also be detected in the mid-range and luxury single family sectors, however demand at the affordable end of the market remained weak. Activity by first time homebuyers has been stubbornly and abnormally low for the last year-and-a-half and is not compensating for the large loss in investor demand that prevailed from 2009 through mid-2013.

- According to Bright Future Real Estate Research, housing permits in greater Tucson were down a shocking 22.5 percent in January vs. a year ago and down 56.3 percent compared to December. According to Bright Future, the change in permit activity can be largely attributed to the reinstatement of impact fees by the city of Tucson.

U.S. Snapshot:

- Leading indicators slowed in January, compared to December, increasing 0.2 percent over the month. Although this doesn’t look all that strong, steady rates of sustainable modest growth are a positive for business planning. Two other readings underscore the steady rate of growth. Coincident indicators were also up 0.2 percent for a second straight month and lagging indicators were up 0.3 percent for the third straight month.

- The industrial sector turned modestly positive in January. Industrial production for January rebounded 0.2 percent after a December decrease of 0.3 percent. Market expectations were for a 0.4 percent gain.

- Capacity utilization was unchanged at 79.4 percent (see chart below).

- Housing is not adding to economic momentum. Housing starts slipped in January on weakness in single family starts. Housing starts declined 2 percent in January after a 7.1 percent jump the month earlier. Single family starts dropped 6.7 percent after a 7.9 percent boost in December. Multi-family starts gained 7.5 percent following a 5.6 percent rise in December.

- Builder confidence in the market for newly built single family homes in February fell two points to a level of 55. This is down from 57 in January. Any number over 50 indicates that more builders view conditions as good than poor.