The Monday Morning Quarterback: A quick analysis of important economic data released over the last week.

The Monday Morning Quarterback: A quick analysis of important economic data released over the last week.

By Elliott D. Pollack and Company

Arizona Snapshot:

The key to understanding the local economy is to compare what is being realized against what one would expect given the current economic challenges. Full job recovery will happen in the earlier parts of next year, but full housing recovery will not occur until some additional things unwind. It will get better though. More on this in later reports.

This past week’s local economic data:

- According to the Cromford Report, active listings in the Greater Phoenix market are down 6.4% over a year ago. Prices in the market have flattened. While they are up 7.1% from a year ago, they are little changed over the past several months.

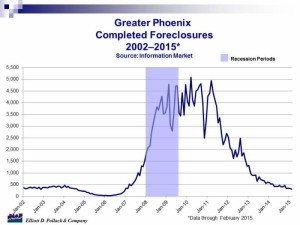

- The number of residential foreclosures in Greater Phoenix in February was 303. This was down from 517 a year ago. The current level of foreclosures is now almost back to levels reported in 2002-2004 (see chart below).

- According to CBRE, the Greater Phoenix office market ended Q4 2014 with a vacancy rate of 21.1%. This is only slightly lower than Q3 and 130 basis points down from the 22.4% vacancy rate a year ago. Absorption for the year was about 1.97 million sq. feet.

- The overall retail vacancy rate in Greater Phoenix declined to 9.6% in Q4 2014. This is down from 9.9% in Q3 2014 and 10.2% a year earlier. Absorption was nearly 1.49 sq. feet for the year.

U.S. Snapshot:

The monthly jobs report continues to surprise on the upside with 295,000 new positions being added in February. This exceeded expectations and aided in bringing the unemployment rate down to 5.5%. However, the unemployment rate does not count people that are no longer looking for work. A reduction in labor force participation also contributed to the impressive unemployment rate. Job gains were realized in multiple sectors, the largest including leisure and hospitality (66,000 jobs), trade, transportation and utilities (62,000 jobs), and education and health services (54,000 jobs). Despite the positive news, manufacturing hiring was weak and construction employment remains well below previous highs. It is interesting to note that this isn’t just an Arizona phenomenon.

- Consumer credit rose $11.6 billion in January (0.3%) in January. But, the gain was centered in non-revolving credit which rose $12.7 billion (0.5%) reflecting strength in auto financing and the government’s acquisition of student loans. Revolving credit fell $1.1 billion (-0.1%) in January after a $6.2 billion (0.7%) rise in December during the holiday season when consumers used their credit cards.

- Construction spending unexpectedly declined 1.1% in January after gaining 0.8% in December. The decline was led by public construction spending. Total construction spending was up 1.8% from a year ago.