The Monday Morning Quarterback: A quick analysis of important economic data released over the last week

The Monday Morning Quarterback: A quick analysis of important economic data released over the last week

By Elliott D. Pollack and Company

This week’s focus is on jobs.

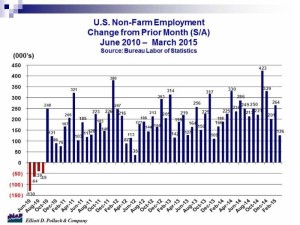

The March employment report showed that a lackluster 126,000 new jobs were created last month compared to February. The nation had been trending at around 250,000 new jobs for the past several months (see chart below). So, what does this actually mean? At the moment it means very little. To some extent a slowdown was expected (just not as severe as what was posted last week).

The official “culprits” are cold weather, a strong dollar, and a decline in the price of oil. There is some truth to these points. When half of the U.S. population is covered in snow, less is produced and less is consumed. The economy slows slightly and both job creation and output are dampened. This also happened last year; it is not a new concept. A stronger dollar implies fewer exports. This would similarly soften new job creation. As for oil prices, there are a couple arguments. First, low prices cause less related production activity in the U.S. This negatively impacts job growth. On the other hand, lower prices also translate into consumers spending less at the pump and more at other places. This would positively impact the employment situation. In reality, there is a little of both going on here.

Based on these arguments alone, one would expect weaker to moderate employment growth going forward. However, there are other things to consider. Large discrepancies between initial and final employment estimates have been realized this past year. Two months ago the final employment statistic was 56,000 less than the initial release; and two months before that the initial release was raised by 102,000 after time passed and better figures were collected. Furthermore, one month does not make a trend. This is why we look at more than one data series.

Most of the other economic statistics that we track and summarize for you each week point to a steadily improving U.S. economy, not one that is dipping toward the next recession. While it is tempting to place a lot of weight on the most recent data release or one that yielded unexpected results such as this, the broader economic summary is no different this week than it was last week. Having said that, keep an eye on this statistic for the next two months. If the job situation does not improve from what we just realized, then we may need to grab a beer and chat.

Some additional U.S. economic statistics are provided below along with supporting charts. We will get back to the Arizona discussion next week.

U.S. Snapshot:

- The U.S. unemployment rate remained unchanged in March at 5.5 percent. This remains the lowest rate since May 2008. A year ago, the U.S. unemployment rate was 6.6 percent. Meanwhile, a broader version of the unemployment rate, which includes people working part-time because they cannot find full-time employment and marginally attached workers, dipped slightly in March to 10.9 percent from 11.0 percent in February.

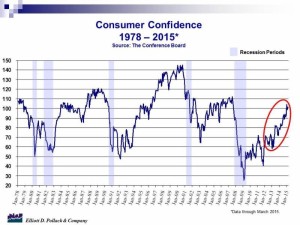

- Consumer confidence jumped to a favorable 101.3 in March. Gains were centered in the expectations component. The Conference Board index remains close to January’s 7-1/2 year high of 103.8 (see chart below).

- Personal income growth remains moderately strong. In February, personal income was up 4.5 percent over a year ago and 0.4 percent over January. But, spending has been softening in recent months due to the severe winter weather. Personal consumption expenditures were up 3.3 percent over a year ago and 0.1 percent over January.