The Monday Morning Quarterback

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

By Elliott D. Pollack and Company

The last week yielded nothing exciting in terms of economic statistics. But, it does provide a chance to remind those interested in the bigger picture that is developing. This has been quite the case study in what Arizona would look like if growth was not a major component of the economy for any lengthy period of time. Despite the lack of help from construction and other related industries, the state, and especially the Greater Phoenix area, are still posting respectable job growth statistics.

“Respectable” needs to be put in the proper context. Last year’s statewide employment growth rate of about 1.9 percent (and current year-to-date rate of 2.6 percent) would normally not seem like a decent number compared to our history. But, when compared to how far we fell during the downturn and how the current recovery shaped up, those numbers don’t look all that bad.

The important thing is to pause and review the current economic statistics with the proper perspective. Most indicators are trending upwards, even with the occasional hiccup. There is nothing currently indicating we are about to fall off a cliff. The most likely economic scenario is for continued growth, especially here in Arizona. If economic problems are to later arise, there will be signals paired with some list of economic shocks.

One previously mentioned shock is the stock market growing rapidly then falling, but the rapid growth from the past year has subsided. Another was the Fed acting too quickly on interest rates. The plan for a June increase is now being reconsidered. The list goes on. Thus, remain optimistic about the economy in the shorter term, but pay attention to any longer list of economic concerns that may develop over time.

The following lists the economic data that came out this past week for the U.S. and for the state.

Arizona Snapshot:

- Enplanements and deplanements at Phoenix Sky Harbor Airport were up again in March. The total of the two are now at new record high for monthly traffic, up 5.5 percent from a year ago. This is a good sign for tourism and travel.

- Greater Phoenix housing affordability improved slightly in the first quarter of 2015 as 70.2 percent of new and existing homes sold were affordable to families earning the local median income. This compares to 68.3 percet a year ago.

U.S. Snapshot:

- Consumers became more skeptical about the economy in early May. The University of Michigan preliminary consumer sentiment index fell nearly 7.3 points over the month to 88.6 in May.

- Retail sales in April came in flat month-over-month. The surprising weakness was concentrated on some of the core readings including department stores, electronics & appliances, food & beverages, and furniture. Motor vehicles also showed declines. Year to date, total retail sales are up only 0.9 percent.

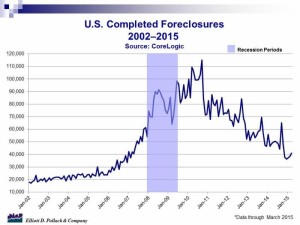

- Nationally, there were 41,000 foreclosures in March according to CoreLogic. This is a 15.5 percent decline from the 48,000 foreclosures a year ago. For comparison, before the decline in the housing market, foreclosures averaged 21,000 per month between 2000 and 2006 (see chart below).