CoreLogic’s April 2015 National Foreclosure Report shows dramatic year-over-year declines in both delinquencies and completed foreclosures and a foreclosure inventory that has shrunk to less than a third of its peak level. It also shows these statistics remain at levels far above historic “norms.”

CoreLogic’s April 2015 National Foreclosure Report shows dramatic year-over-year declines in both delinquencies and completed foreclosures and a foreclosure inventory that has shrunk to less than a third of its peak level. It also shows these statistics remain at levels far above historic “norms.”

Since the financial crisis began in September 2008, there have been approximately 5.7 million homes lost to foreclosure nationwide and since homeownership rates peaked in the second quarter of 2004 there have been approximately 7.8 million foreclosures, the report stated,

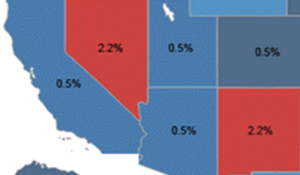

The five states with the highest number of completed foreclosures for the 12 months ending in April 2015 were: Florida (106,000), Michigan (49,000), Texas (33,000), Ohio (28,000) and Georgia (27,000). These five states accounted for almost half of all completed foreclosures nationally.

As of April 2015, the national foreclosure inventory, that is homes in the process of foreclosure, stood at approximately 521,000, or 1.4 percent, of all homes with a mortgage.

Arizona’s inventory was 0.8%.