The Monday Morning Quarterback /A quick analysis of important economic data released over the past week\

The Monday Morning Quarterback /A quick analysis of important economic data released over the past week\

Elliott D. Pollack & Co.

While there was some negative news on the economic front, most of it was positive. And while the news media continue to pound the “interest rates are going to rise – oh no!!!” drum, it is overdone. The last thing the Fed wants to do is throw the economy into a recession or even a slowdown in the mediocre rate of growth that has been the characteristic of this recovery. Don’t lose any sleep over it at this point. Basically, the data suggests more of the same in terms of growth.

The housing market will recover slowly, mainly due to a combination of factors we have discussed before. These include the ending of the lock out period for those who were foreclosed upon or who did a short sale, the different marriage and home ownership characteristics of millennials and the large amount of student loan debt they have burdened themselves with, slower real income growth and, mainly, the lack of real ease in credit markets (especially related to down payment requirements).

So, the housing recovery will continue to be slower than most would like and continue to be a damper on this recovery relative to past recoveries. Look at the bright side. The expansion is likely to continue for quite some time unless something unusual happens. That’s not bad news.

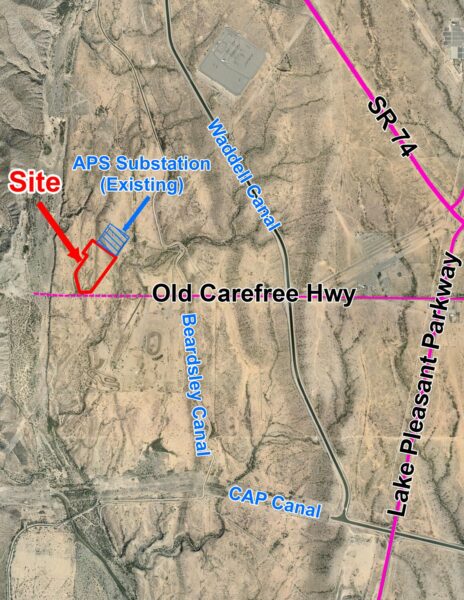

Arizona Snapshot:

Total claims for unemployment insurance in Arizona, while up for the past three weeks, are 12.5% below year earlier levels.

The S&P/Case-Shiller Home Price Index for Greater Phoenix was up 0.8% for the month in May and was up 3.8% from a year ago (see chart below).

The homeownership rate in Greater Phoenix was 60.9% in the second quarter compared to 61.4% a year ago. In Tucson, the rate was way down from the 72.2% of a year ago to 64.5% in the second quarter of this year.

According to CBRE, vacancy rates in the Greater Phoenix office market declined to 21.1% in the second quarter compared to 22.0% a year ago. Vacancy rates need to approach 15% for the market to be normalized.

CBRE puts retail vacancy rates in Greater Phoenix at 9.0% in the second quarter. This is down from 9.8% a year ago. Industrial vacancies over the same period declined to 10.9% from 11.1% a year ago.

According to Cushman & Wakefield, office vacancies in Tucson increased from 12.3% a year ago to 12.5% in the second quarter of this year. Retail vacancy rates also rose from 6.5% a year ago to 6.7% in the second quarter. Industrial vacancy rates declined from 11.6% a year ago to 10.0% in the second quarter.

U.S. Snapshot:

Second quarter real GDP growth, as expected, accelerated from the upwardly revised (but still mediocre) 0.6% growth of the first quarter. With the very cold weather and the West Coast port slowdown of the first quarter now behind us, the second quarter expanded at a 2.3% annual rate (see chart below). While this is certainly not record shaking, it is about the rate that the economy is likely to grow in the second half as well.

Slow real wage grow was reported in the second quarter. The employment cost index inched up a modest 0.2% in the second quarter after a surge of 0.7% in the first quarter. Over the last year, the index is up 2.0%. This certainly is not indicative of tight labor markets. That will get the Fed’s attention when considering, however modest, rate increases.

On the less positive side, consumer confidence weakened substantially in July to 90.9. The index dropped from 99.8 in June. In May, it was 94.6. The question is now whether June was an aberration. The reading might have been a result of all the news of the non-events in Greece and China. The August reading will tell the story.

The University of Michigan Consumer Sentiment index for July also dropped, but not by as much. The July reading was 93.1 compared to 96.1 in June. This reading is still at a high level.

Durable goods orders, both defense and non-defense, remain modestly down from a year ago but up from last month. The reading for core capital goods, which excludes aircraft, rose a solid 0.9% for the month.

Surprisingly, the homeownership rate in the U.S. declined from a year ago. Last year the reading was 64.7%. In the second quarter of this year, it fell to 63.4%. This doesn’t speak well for housing.

The U.S. S&P/Case-Shiller Home Price index for the 20 city composite was up 1.1% for the month in May (the latest data available) and now stands 4.9% above a year ago.