(NEWS RELEASE) Cushman & Wakefield, a global leader in commercial real estate services, announced today that the Metro Phoenix office market posted its strongest quarter of absorption in since 2005 with 1.5 million square feet (msf) during Q4 of 2015.

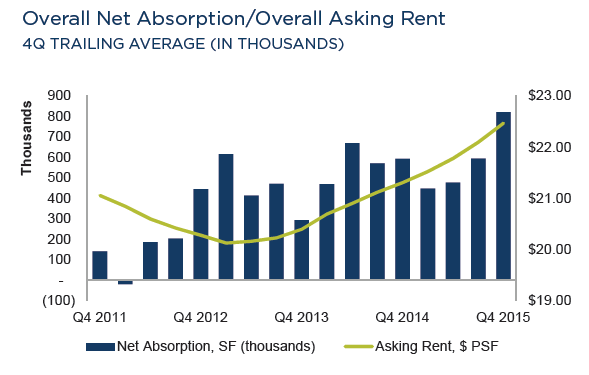

The year closed with a total 2015 absorption of 3.3 msf and occupancy growth in 17 of the 22 metropolitan submarkets during Q4. Vacancy in Phoenix closed the year at 18.7%, down 20 basis points from the previous quarter and down from 19.1% at year-end 2014.

“Our market builds strength with each passing quarter,” says Curtis Hornaday, Research Analyst with Cushman & Wakefield. “Metro phoenix added nearly 50,000 jobs last year and our unemployment rate dropped to 5%. Approximately 12,600 of those jobs were in the office sector. The improving health of our economy with growing companies and businesses relocating to the Valley has driven demand for our office market.”

“Our market builds strength with each passing quarter,” says Curtis Hornaday, Research Analyst with Cushman & Wakefield. “Metro phoenix added nearly 50,000 jobs last year and our unemployment rate dropped to 5%. Approximately 12,600 of those jobs were in the office sector. The improving health of our economy with growing companies and businesses relocating to the Valley has driven demand for our office market.”

The Tempe North submarket led the metro area in Q4 absorption with more than 616,000 square feet of net absorption, accounting for 41% of the Metro Phoenix absorption. State Farm took possession of its first of five regional headquarters buildings, which accounted for 375,000 square feet of that absorption. The third building of the Hayden Ferry Lakeside Business Park was completed in Q4, adding 200,000 square feet to the absorption because of strong preleasing.

Class A and B space has garnered positive growth during the quarter but Class C space posted its first net loss since Q1 2015. Class A space accounted for 73% of the total net gain of absorption in Q4. Tenant demand for high quality Class A space has led the Class A vacancy to drop to 15.3%.

Construction of new office space in 2015 reached its strongest level since 2008. More than 3.0 msf of new space was added to the inventory, 63.2% of which was preleased. Nine new projects totaling almost 1.5 msf were delivered in Q4, 72% of which was preleased. Two significant new projects were started during Q4, both being redevelopment efforts. The projects are located in the Sky Harbor Airport area and Downtown Phoenix. Within the “warehouse district” of Downtown, a 122,000-square-foot former warehouse building is being converted into creative office space with collaborative, open space design. Scheduled for completion in Q4 of 2016, the property will be occupied by tech companies Galvanize and WebPT.

While Metro Phoenix still posts vacancy in the high teens, asking rental rates have continued to rise. The current asking rental rate is $23.09 per square foot (psf) on an annual full service basis This is an increase of 6.8% over the past year. The Camelback Corridor ($29.78 psf) and Scottsdale South ($28.09 psf) top all other submarkets in price and those submarkets’ Class A space commands the highest rates at $33.28 psf and $29.74 psf respectively.

“Preleasing of new projects and strong build-to-suit activity have spurred a very strong recovery for the office market,” said Hornaday. “Despite adding over 3.00 msf to our local inventory, we are happy to see our vacancy rate continue to decrease. During early 2016 we expect to experience more rental rate increases of Class A and B space. We anticipate further movement towards an overall vacancy in the mid teens as the year unfolds.”

View the Market Report, which breaks down various submarkets and other details.