ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

April 11th, 2016

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

It looks like the first quarter of 2016 will show little growth. Weakness in manufacturing and a necessary reduction in inventories will cause the first quarter to be weaker than the consensus forecast of 2.0% for the year as a whole.

Despite that, the outlook seems reasonable. Labor markets appear strong. The unemployment rate is likely to continue to decline and more people are likely to reenter the labor force. This will lift consumer spending. Also, the Fed is likely to raise rates only slowly over the next several months.

The Greater Phoenix economy, accounting for the bulk of employment growth in the state during this cycle, seems to be gaining steam. This should carry the balance of the state that, so far in this cycle, has been anemic.

U.S. Snapshot:

- The Blue Chip consensus forecast now shows that 2016 will be a weak year. The current forecast is for 2.0% real GDP growth this year and 2.3% next. In both 2014 and 2015, real GDP growth was 2.4%.

- New orders for manufactured goods in February, down for three of the last four months, decreased by 1.7% from January on a seasonally adjusted basis and now stands 3.0% below a year ago. Inventories also dropped.

- The ISM non-manufacturing index rose in March by 1.1 percentage points over the February reading of 53.4. This indicates continued growth in the non-manufacturing sector for the 74th consecutive month. A reading above 50 indicates expansion.

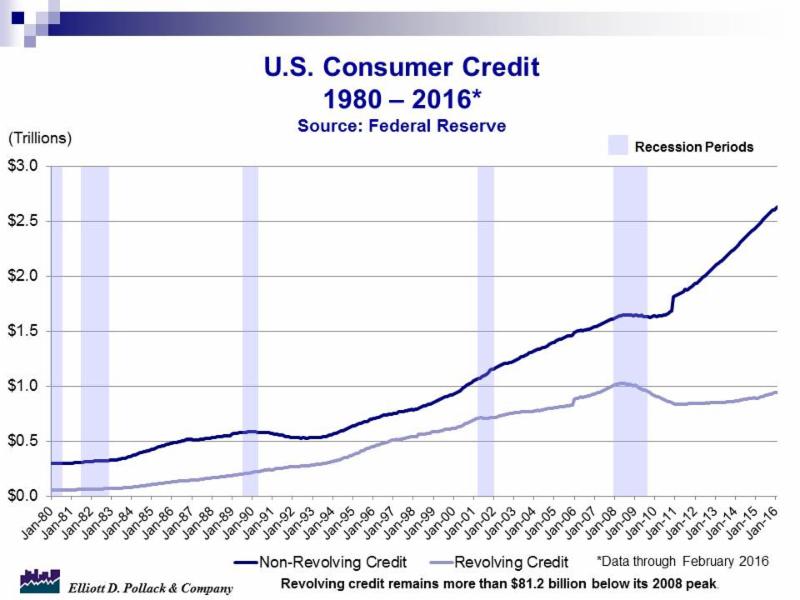

- Non-revolving credit (mainly auto and student loan debt) rose 0.5% for the month in February and now stands 6.9% above a year earlier. Revolving credit (mainly credit cards) rose 0.3% and now stands 5.7% above a year ago (see chart below).

- 30-year mortgage rates for the week of April 7th were 3.59%. This compares to 3.71% the previous week and 3.66% a year ago.

Arizona Snapshot:

- The median price of a single family home sold in Greater Phoenix was $230,000 in March. This is the same as in February and up from $218,000 a year ago.

- In Greater Tucson, the median sales price of a single family home sold was $190,000. Total active listings were 4,802 in the region, which is a decrease of 5.4%from February’s 5,078.