By Amy Swinderman | inman

When a buyer client sees a news story about something that could affect the home loan, chances are high that real estate agents will be getting some borderline panicked questions in the near future.

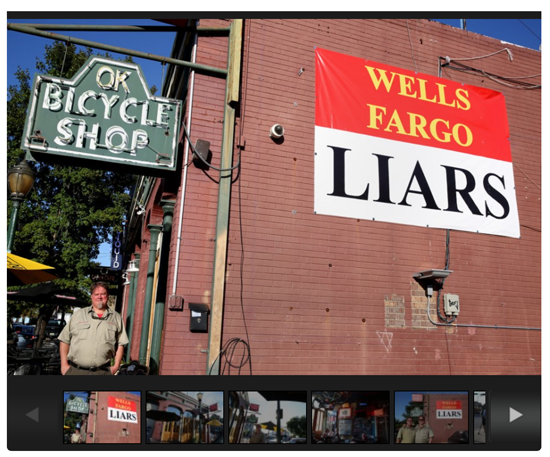

Fallout from Wells Fargo’s employee cross-selling scandal continues to raise questions about how the bank’s customers were harmed by the illegal scheme — including their ability to access financial products and services like mortgage loans.

Fallout from Wells Fargo’s cross-selling scandal raises questions about mortgage services