REALTORMag

The average American household spends $2,149 on property taxes for their homes each year, according to U.S. Census data. But depending on where you live, that can vary drastically.

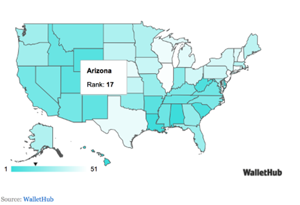

For the third consecutive year, New Jersey ranks as having the highest property taxes in the nation, according to a new report released by WalletHub. Its effective tax rate of 2.35 percent means homeowners there pay about $7,410 annually on a $316,000 home, the median sales price in the state.

On the other hand, Hawaii has the lowest property taxes in the nation. At just a 0.27 percent effective tax rate, annual taxes on a median price home in Hawaii at $515,300 comes to about $1,406 a year.