Homeownership rate remains below normal level

Homeownership rate remains below normal level

By Laura Kusisto | The Wall Street Journal

The decline in homeownership rates to near 50-year lows is partly to blame for the U.S. economy’s sluggish recovery from the last recession, new data suggest.

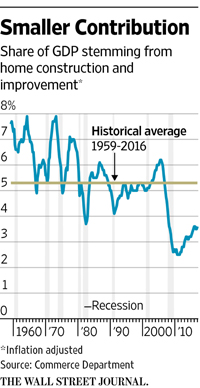

If the home-building industry had returned to the long-term average level of construction, it would have added more than $300 billion to the economy last year, or a 1.8% boost to gross domestic product, according to a study expected to be released Monday by the Rosen Consulting Group, a real-estate consultant.

In 2016, total spending on housing declined to 15.6% of GDP, a broad measure of goods and services produced across the U.S., compared with a 60-year average of nearly 19%. The share of spending specifically linked to new-home construction and remodeling likewise declined to 3.6% of GDP, just over half its prerecession peak in 2005.