ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

July 17th, 2017

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

This week’s data shows a more mixed picture than it has in a while. In particular, consumers used their credit cards at a faster than expected rate while consumer sentiment gave signals of possible slowing ahead. In addition, retail sales moderated somewhat while manufacturing and trade sales and industrial production reported more satisfactory performances.

It is not unusual for economic data to be mixed at this stage of the business cycle. Nor does it indicate that there is a significant problem with the economy. It simply means that not every indicator will be rosy from here on out.

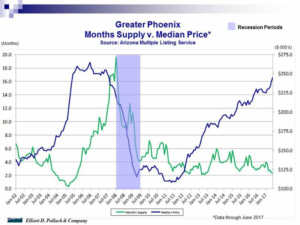

As for Arizona, most of last week’s information is related to single family housing. The single family markets in both Greater Phoenix and Greater Tucson continue to show strength in activity and pricing. The only issue continues to be on the supply side where the number of homes on the market remains lower than normal by historic standards.

U.S. Snapshot:

- According to the University of Michigan consumer sentiment index, economic expectations are falling while current conditions remain high, a combination that the report warns of potential economic slowing ahead. The overall index fell two points in the preliminary results for July to a lower than expected 93.1. A year ago, the index stood at 90.0. The issue raised by this report was that the expectations component of the survey fell by nearly four points to 80.2 for its lowest reading since the election. Interestingly enough, the largest decline came from Republicans whose expectations fell sharply from very high levels. Democrat expectations actually improved but remain at much lower levels. Current conditions actually rose slightly which is a positive indication. But, it’s future activity that needs watching.

- Consumer spending has been modest but consumers did run up their credit card debt in May helping lift consumer credit outstanding by a larger than expected amount. Revolving credit, which is where credit cards are tracked, rose at an 8.7% annual rate vs. a modest 1.4% annual rate in April. Nonrevolving credit, where auto financing and student loans are the biggest factors, posted yet another sizable increase in May. Overall, nonrevolving credit, which is about 2.8 times larger than revolving credit in total size, rose at a 4.7% annual rate. Credit card debt may not be a plus for long-term consumer health, but, it is one for near-term consumer spending and GDP.

- Consumer prices were flat in June compared to May and now stand 1.6% above year earlier levels. Inflation for all items less food and energy, known as the base rate of inflation, was up a modest 0.1% for the month and up 1.7% from a year ago.

- Retail sales declined 0.2% in June when compared to May but were still up 2.8% from a year ago. The April-June period showed a total year over year increase of 3.8%.

- Total manufacturing and trade sales were down modestly (0.2%) for May when compared to April. But, on a year over year basis, they were up a satisfactory 5.1%. The inventories to sales ratio rose slightly to 1.38 in May compared to 1.37 in April and 1.41 a year ago. A declining ratio is considered positive at this stage of the cycle.

- Industrial production rose 0.4% in June when compared to May and now stands 2.0% above a year ago. This is a sign that manufacturing activity continues to move forward.

Arizona Snapshot:

- The total number of resale homes in Maricopa County was 9,791 units in June. This compares to 9,075 a year ago. That’s a 7.9% gain. Prices as measured by the median sales price of a resale home were up to $240,000. This is a 4.8% gain from a year ago.

- The months supply of listings in the multiple listing service for the Greater Phoenix area (ARMLS) fell to a low 2.3 months in June compared to 2.4 months in May and 2.8 months a year ago (see chart below). This relatively low level of inventory will continue to create pricing pressure in the near term.

- Total listings in the Greater Tucson MLS have also declined. Total listings in June were 3,625 compared to 4,175 a year ago. Prices continue to climb in the market as prices for all types of homes were 5.3% higher than a year ago in June.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200