The Fair Share Campaign begins work on fixing a broken tax code

(Editor’s note: News releases are published as submitted unless they contain errors of fact.)

Phoenix, AZ – The Arizona Center for Economic Progress launched the Fair Share Campaign today.

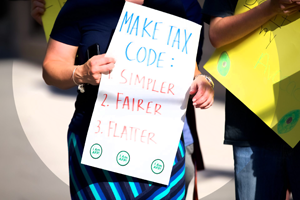

The Fair Share Campaign seeks to clean up Arizona’s tax code and eliminate special interest tax breaks so our communities can prioritize the services that benefit everyone, like quality public schools for every child, affordable college tuition, safe roads and other vital infrastructure.

“Unfortunately, some in Arizona are getting special breaks that undermine the priorities that benefit all Arizonans,” said David Lujan, Executive Director of the Arizona Center for Economic Progress. “Arizona’s tax code is littered with exemptions and tax cuts which benefit a few, leaving our state with insufficient revenue. Arizonans deserve a tax code that works for everyone – not just special interests. When everyone is doing their fair share, then we can focus on the priorities that matter most. Our current tax code just doesn’t make sense”.

According to the most recent data available, 74% of Arizona corporations are able to reduce their income tax liability to $50 or less. Our state legislature cannot even provide evidence on whether Arizona is getting any benefits in return for all of those tax cuts.

According to the most recent data available, 74% of Arizona corporations are able to reduce their income tax liability to $50 or less. Our state legislature cannot even provide evidence on whether Arizona is getting any benefits in return for all of those tax cuts.

A look at some of the problems with Arizona’s tax code

-

Tax cuts enacted over the past decade are not benefiting most Arizonans

-

This year’s corporate income tax collections are projected to be the lowest since 1993 ● Tax credits costs the state budget $618 million in FY2017 and have been growing fast ● We do not know whether we are getting sufficient ROI on tax credit giveaways

-

There are too many sales tax loopholes

-

There are not enough sales tax auditors and collectors

Over the course of 2018, The Fair Share Campaign will seek to build the statewide resolve needed to tackle these issues. Six bills will be introduced in the 2018 legislative session to address our tax code’s problems, and while these bills represent steps in the right direction, this campaign will continue building statewide support needed to take bolder steps in the future.

Bills to get our tax code moving in the right direction

Bill 1: 74% of Arizona corporations are able to reduce their tax liability to pay the current $50 minimum tax or less. This legislation will ensure that all corporations pay at least $500 in income tax no matter how many tax breaks they claim.

Bill 2: This legislation takes the first steps in eliminating sales tax exemptions on certain goods and services for which it does not make sense to exempt from sales tax, starting with the sales of fine art that is shipped out-of-state, private jets, service contracts and warranties, horse vitamins, and 4 inch diameter pipes.

Bill 3: Stops the annual automatic 20% growth of corporate private school tuition tax credits and stops subsidizing private school tuition for families who can already afford it by limiting private school tuition tax credit scholarships to low income families.

Bill 4: Repeals tax credits that have already been deemed ineffective by a bipartisan legislative oversight committee; places a 5-year sunset date on all tax credits; and requires legislation be introduced to take action on any tax credits recommended for repeal by the Joint Legislative Income Tax Credit Review Committee.

Bill 5: Appropriates funding to the Arizona Department of Revenue to hire additional auditors and collectors to collect taxes that are owed to the state.

Bill 6: Establishes one formula for determining how corporate income is taxed rather than allowing corporations to choose the formula which results in paying the least amount.

These bills alone will not clean up our tax code, but they will highlight the problem areas and they will serve to generate the statewide discussions we need to have and shift our legislature’s priorities back to what matters. It’s time to fix our tax code so it works for all Arizonans.