ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

April 30th, 2018

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

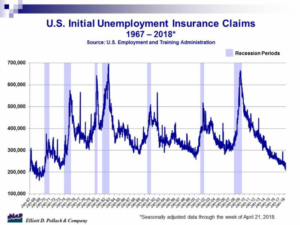

It was yet another week of good news for the economy. Real GDP exceeded expectations. Consumer confidence continues to be strong. Initial claims for unemployment insurance are the lowest since December 1969. The housing market continues to be strong and housing prices continue to rise (this gives home owners more equity in their homes). Business spending continues to do well. And even international trade was a plus.

For Arizona, statewide and Greater Phoenix lodging performance improved. In Greater Phoenix, single family home prices continued to increase. And the office, retail and industrial markets continued to improve.

Altogether, this is quite a good performance. Additionally, given the recent tax cuts combined with likely increases in government spending, the rest of the year is likely to grow at more rapid rates than was experienced in the 1st quarter.

U.S. Snapshot:

-

Initial unemployment insurance claims were down to 209,000. This is the lowest level for initial claims since December 6, 1969 (see chart below). What makes this so impressive is that in 1969, there were significantly fewer people in the labor market than there are today.

-

Real gross domestic product (GDP)-the value of all goods and services produced in the country-increased at a 2.3% annual rate in the 1st quarter. This was higher than the general expectation of 2.0%. The 2.3% annual rate was lower than the 4th quarter result of 2.9%. But, growth has been routinely weak in the 1st quarter over the last few years. Economists at least partly believe this is due to government measuring problems. The 1st quarter was powered by a strong business sector. In addition, trade was unexpectedly a net positive for growth as exports grew faster than imports. The consumer sector, after a strong 4th quarter, was weak in the 1st quarter. Growth is likely to be higher the rest of the year as federal tax cuts and spending increases kick in.

-

The Conference Board’s Consumer Confidence index rose 1.7 points in April to 128.7. This offset roughly half of last month’s 3-point decline. Both months are considered high by historic standards. Consumer confidence remains near its highest level in a generation.

-

The University of Michigan Consumer Sentiment index lost 2.6 points in the final April report. The 98.8 level is the lowest in three months. Despite this, consumer sentiment remained quite strong in April.

-

The S&P/Case-Shiller Home Price Index reported a 6.3% annual gain in February. The 10-city composite annual increase came to 6.5%, up from 6.0% in the previous month. The 20-city composite posted a 6.8% year over year gain, up from 6.4% in the previous month. Overall, housing prices continue to increase more rapidly than inflation. Given the current supply/demand situation, this is likely to continue.

-

Sales of new single family houses in March were 694,000 at an annual rate. This is up from 667,000 at an annual rate in February and 638,000 a year ago. The median price of a new house was up 4.8% from a year ago.

Arizona Snapshot:

-

Statewide lodging performance continued to improve in the 1st quarter. Occupancy rates increased to 73.7% compared to 72.4% a year ago. Demand increased 3.6% while supply increased 1.8%. In Greater Phoenix, occupancy rates increased in the 1st quarter to 80.7% compared to 79.3% a year ago. Demand in the Phoenix market grew by 4.2% over a year ago while supply increased by 2.4%.

-

According to the Census Bureau, Arizona’s rental vacancy rate was 5.0% in the 1st quarter compared to 5.9% a year ago. In Greater Phoenix, rental vacancy rates fell to 4.6% from 4.7% a year ago.

-

According to CBRE, Greater Phoenix office vacancy rates fell to 16.5% in the 1st quarter. This is down from 17.3% a year ago. CBRE reported that industrial vacancy rates fell to 6.7% in the 1st quarter. This is down from 8.2% a year ago. The retail vacancy rate decreased from 8.8% to 8.4% from a year ago.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200