Cuts give states a cash windfall. What now?

The federal tax overhaul cut taxes for millions of American families and businesses. But the law also had an unintended effect: raising the state-tax bite in nearly every state that has an income tax, The New York Times reports.

Related: House Speaker says changes needed to keep state income taxes from increasing

Push on to fix adverse effect of Trump tax cuts on state taxpayers

Now, governors and state legislators are contending with how to adjust their own tax codes to shield their residents from paying more or, in some cases, whether to apply any of the unexpected revenue windfall to other priorities instead.

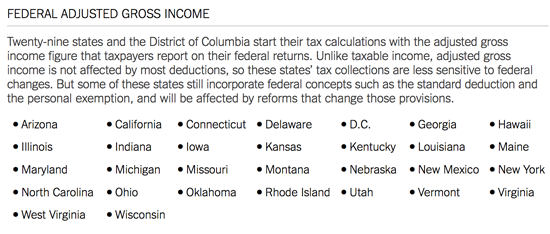

The Tax Cuts and Jobs Act cut federal tax rates, but also made other changes that mean more income will be subject to taxation. Because most states use federal definitions of income and have not adjusted their own rates, the federal changes will have big consequences for both state budgets and taxpayers.

The federal tax overhaul, which eliminated or capped several deductions and exemptions, effectively broadened what counts as income for some families, The Timessays. At the state level, the changes leave families owing tax on a larger share of their income, without the reduced rates or new credits to soften the blow.

Several factors are complicating the issue for states. Congress passed its tax overhaul late in the year and with minimal debate, giving states relatively little time to assess the effects and plan a response. Even now, the full impact on state budgets is not clear, meaning legislatures are deciding how to take advantage of a revenue stream that could fall short of estimates. In addition, most of the changes to the individual tax code expire after several years, further muddling states’ plans.