FOR IMMEDIATE RELEASE

FOR IMMEDIATE RELEASE

August 6th, 2018

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

It’s beginning to sound like a broken record. The data continue to paint an optimistic picture. And although the upcycle is now nine years old, there is no end in sight. And while some very early stage imbalances may be developing, they are certainly nowhere near the level that would end the cycle at any time soon. This includes all the rhetoric surrounding trade at the moment. We still believe that in the end, cooler heads will prevail and China will become less aggressive in its policies regarding intellectual property. So, enjoy what will likely prove to be about the bottom of the 7th inning.

U.S. Snapshot:

Total nonfarm payroll employment rose by 157,000 in July. The largest increases were in professional and business services, manufacturing and in health care. There were also significant upward revisions in the data for May (revised from 244,000 jobs to 268,000 jobs) and June (revised from 213,000 jobs to 248,000 jobs). After the revisions, job gains over the last three months have averaged 224,000.

The unemployment rate in July edged down to 3.9% from 4.0% last month. The underemployment rate was 7.5%. This is the lowest since 2001.

Personal income grew more rapidly than inflation again. Personal income was up 4.9% over a year ago and grew at a 5.0% annual rate in July over June. Disposable personal income rose 5.4% over year earlier levels and personal consumption expenditures grew by 5.1% over a year ago. The personal savings rate was steady for the month at 6.8%. One year ago, it was 6.6%.

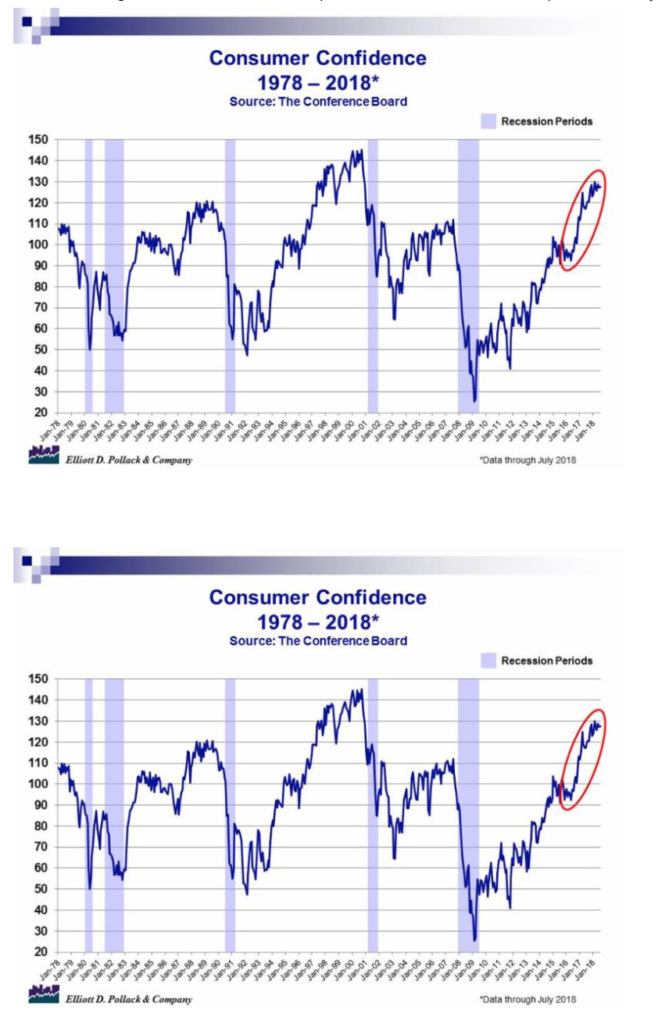

Consumer confidence remained high (see chart below). The July reading as measured by the Conference Board index was 127.4 compared to 127.1 in June and 120.0 a year ago.

The ISM manufacturing index continues to signal growth in the manufacturing sector. The July index stood at 58.1 compared to 60.2 in June and 56.5 a year ago. Any reading above 50 suggests expansion in the sector.

The same is true for the ISM non-manufacturing index. In July, it stood at 55.7 compared to 59.1 in June and 54.3 a year ago. Thus, the index signals continued non-manufacturing growth.

New orders for manufactured goods in June, after being up four of the last five months, increased 6.1% above a year ago. The new orders inventories to shipments ratio fell to 1.33 in June compared to 1.35 in May and 1.38 a year ago. This indicates that inventories are under control.

U.S. light vehicle sales were at a seasonally adjusted rate of 16.7 million units in July. In June, it was 17.2 million and a year ago it was 16.7.

Total construction spending in June was up 6.1% from a year ago. It was slightly down from May’s level.

The National Association of Realtors pending home sales index increased in June at 106.9 from 105.9 in May but was down from the 109.6 reported a year ago.

According to the S&P/Case-Shiller home price index (20-city composite), home prices increased 6.5% over the past year.

Arizona Snapshot:

According to S&P/Case-Shiller, home prices in Greater Phoenix were up 7.3% from a year ago in May.