ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

September 4th, 2018

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

Hope you had a great Labor Day weekend. This weekend usually marks the end of summer time (although not officially) and the beginning of the run up to the holiday season. (That is, of course, unless you have school age kids. In which case, the beginning of the school year marks the end of summer.) With that in mind, we thought it would be a good time to take a look at how the holiday season (economically) might look.

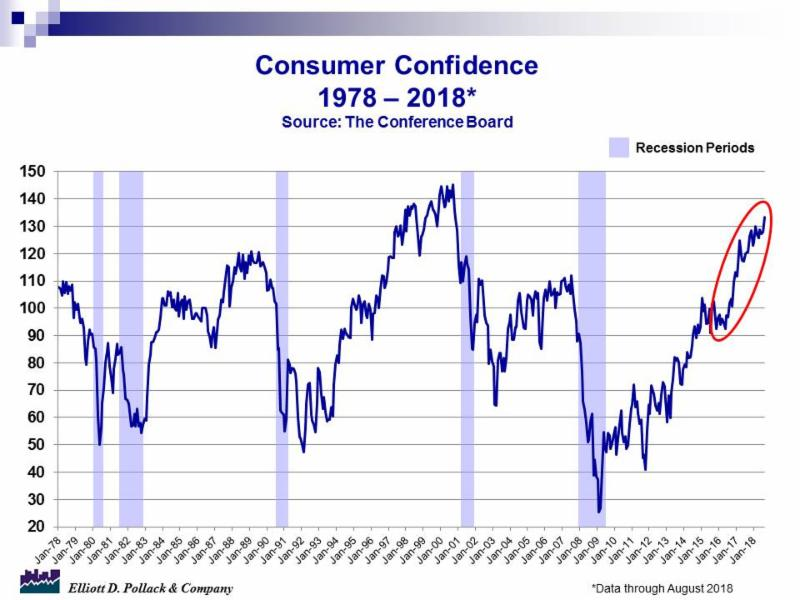

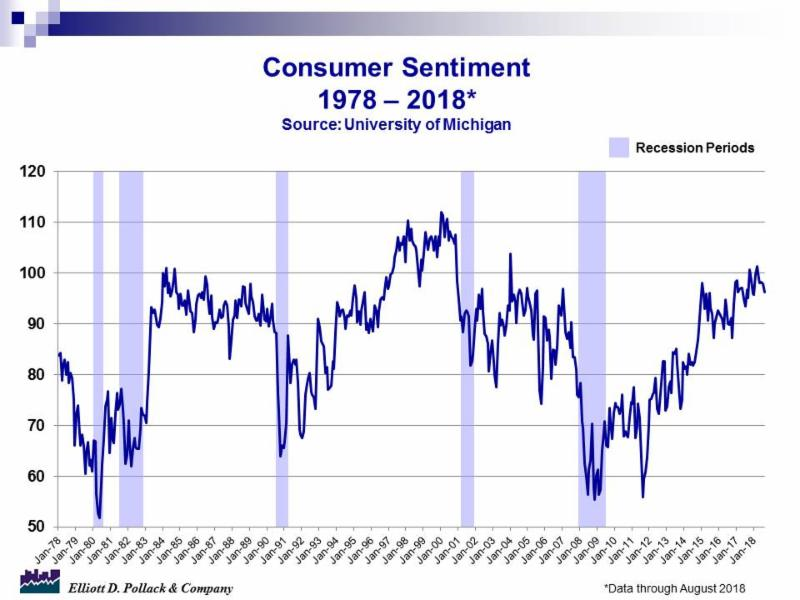

Although the latest readings of the two major indices are not telling the exact same story, both are at high levels. As discussed below, the Consumer Confidence Index compiled by the Conference Board is at its highest level for the cycle. The University of Michigan’s Consumer Sentiment Index is off its high for the cycle due to a weaker reading on current conditions, but it is still at a high level for the cycle. Increases in disposable personal income and personal consumption expenditures and a stable savings rate combined with a continued strong jobs outlook as well as continued stimulus from the tax cuts and fiscal stimulus are also significant positives. On the other side of the coin, continued tightening by the FED and the risk of the unknown could affect the picture, but the probabilities of that seem low at the moment.

Overall, the picture suggests a positive holiday season will soon be upon us. Ho! Ho! Ho!

U.S. Snapshot:

-

As discussed above, the Consumer Confidence Index for August reached a new high for the cycle. It gained 5.5 points, improving to 133.4 from 127.9 in July (see chart below). Present conditions and expectations improved strongly, with present conditions reaching the highest level since 2000 and expectations reaching their highest since February.

-

On the other hand (spoken like a true economist), the August reading from the University of Michigan Consumer Sentiment index, although still high, was at its lowest level since January. The index declined to 96.2 in August from 97.9 in July (see chart below). Most of the August decline was in current economic conditions, which fell to their lowest level since November 2016. These results stand in sharp contrast to the recent very favorable assessments of buying conditions. Concerns about inflation and interest rates as well as future income were the reasons stated for the changed perception. This is typical for the later stages of expansions.

-

Personal income in July was up 0.3% and stood 4.7% above a year ago. Disposable personal income was also up 0.3% and stood 5.3% above year earlier levels while personal consumption expenditures in July were up 0.4% or 5.2% above a year ago. The national savings rate was down very slightly to 6.7% in July compared to 6.8% in June and the same as a year ago.

-

Real GDP for the second quarter was revised upward to 4.2% from the 4.1% originally reported.

-

According to the S&P/Case-Shiller home price index, the 20 city composite was up 0.5% in June compared to May and stood 6.3% above a year ago. Yet, even as home prices keep climbing, there are signs that growth is easing in the housing market. Sales of both new and existing homes are roughly flat over the last six months amidst news stories of an increase in the number of homes for sale in some markets. Rising interest rates (30-year fixed rate mortgages rose from 4% to 4.5% since January) and the rise in home prices are affecting housing affordability. The index shows a wide variation of results over the past year. For example, over that time, Las Vegas home prices were up 13.0%, Seattle was up 12.8% and San Francisco was up 10.7%. On the other hand, Washington D.C. was up 2.9%, Chicago was up 3.3% and New York was up 3.8%.

-

As discussed above, the NAR pending home sales index was down slightly in July to 106.2 from 107.0 in June and 108.7 a year ago. It is evident that in recent months that many of the most overheated housing markets-especially in the west-are starting to see a slight decline in home sales and slower price growth.

Arizona Snapshot:

-

The Greater Phoenix S&P/Case-Shiller home price index was up 0.7% in June over May and stood 7.2% above year earlier levels.

-

The latest transaction privilege tax numbers show a good calendar year-to-date performance in both Maricopa and Pima County. Keep in mind that the numbers for any month on a year over year basis can be volatile. It is safer to use year-to-date over year-to-date numbers. Retail sales in Maricopa County are up 6.4% through June. Restaurant/bar sales are up 5.7% and hotel/motel is up 8.3%. In Pima County, the numbers are 5.5%, 3.6% and 10.2% respectively. Pinal County is also worth noting. They are up 5.1% for retail, 6.1% for restaurant/bar and 18.7% for hotel/motel.

-

City sales taxes and county excise or road tax collections on a fiscal year basis are available through July. So, the fiscal year-to-date and the month over month will be the same. Again, the data becomes more reliable with each additional month on a year-to-date basis. In Maricopa County, collections are up 6.0%. in Pima County, they are up 5.0% and in Pinal County they are up 9.3%.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200