By Callan Smith | Rose Law Group Reporter

The economic outlook for 2019 is good according to Elliott Pollack, who spoke to a large crowd at Rawhide for the twelfth year in a row at a Pinal Partnership event.

Which is especially true for Pinal County, which has seen not one, but two significant employers, Nikola Corp and Lucid, come to the county within 2018, something Pollack hasn’t seen before. They have the potential to create 10,000 jobs, with only partially coming from direct employment. The rest will come from indirect and induced employment in support of those workers and growth.

There are about 60,000 jobs in Pinal County, giving an increase of 15 percent with normal growth on top of that, which is a big deal.

The new norm for Arizona is a strong economy with all the action in Maricopa and Pinal counties, Pollack said.

“The rest of the state could disappear, and nobody would notice for several weeks,” Pollack said, receiving laughter from the crowd.

Greater Phoenix accounted for about 88 percent of all the jobs for Arizona during the recovery.

Pollack does not expect a recession, and it’s too early to tell when a slowdown will be or how much, but it should be mild and won’t occur in 2019. The imbalances in the economy are modest at this time, with strong consumer sentiment and business investment. He cautioned that not all recessions are the same.

The U.S. is in the second oldest economic recovery, and by the summer it will be the oldest recovery in U.S. history.

“The economy has so much power in it. it’s likely to power its way through 2019,” Pollack said.

There are a lot of positives such as the declining unemployment rate, and growth in the employment to population ratio, which is needed as people who left the workforce are returning.

Economic growth is currently at three percent. Pollack cautioned it would not stay there for long, because the ground lost during the recession has been regained.

“We’re going through a period were demographically, the labor force isn’t going to grow that much, so that means the potential economic growth isn’t there and so we’ll probably get back to the low to mid two percent,” Pollack said.

A trade war is also not likely. Pollack describes the current issues as a trade skirmish, saying China can’t afford a full-blown trade war with the U.S. because 20 percent of Chinese exports go to the U.S., compared to five percent to the U.S. It would mean a reduction in Chinese jobs if there were to be an escalation, which they cannot afford.

Trade deficit numbers break down to 365 billion with China, 71 billion with Mexico and 19 billion with Canada.

Population flow is down across the U.S. relative to past cycles. It’s still very strong but is expected to be under two percent for Arizona, which is higher than the U.S. as a whole.

Current conditions in housing are the polar opposite from 2007. There are affordability issues, but Phoenix and Pinal County are still great places for buyers to find homes.

“I expect that even if there is a slowdown in housing, even in Greater Phoenix, it’s going to be mild,” Pollack said.

He’s bullish on housing considering the low resale supply in Phoenix compared to other places such as Las Vegas. Builders are facing increasing construction and commodity costs. Highest selling subdivisions continue to be those offering an affordable product, which Pollack expects will continue.

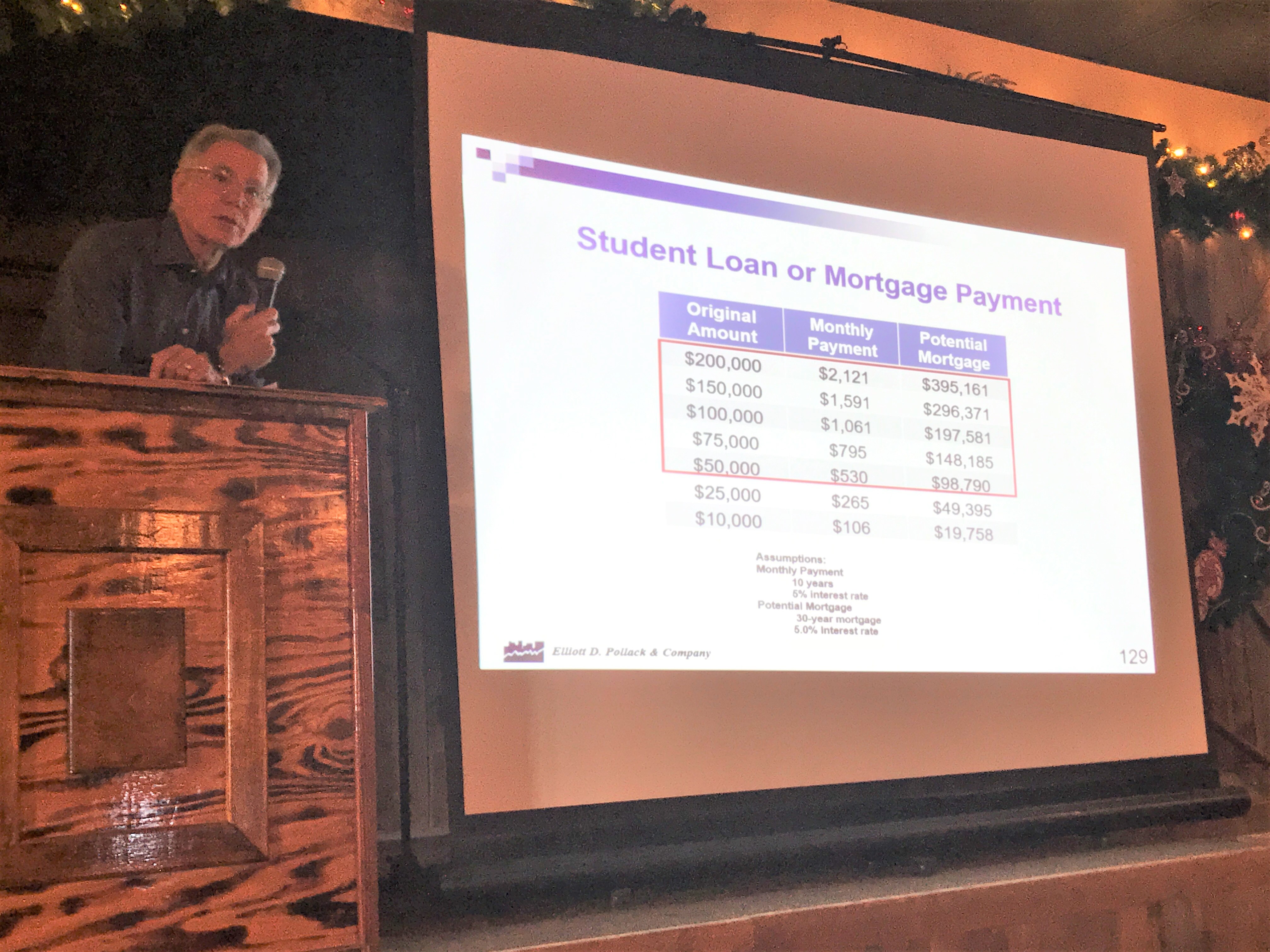

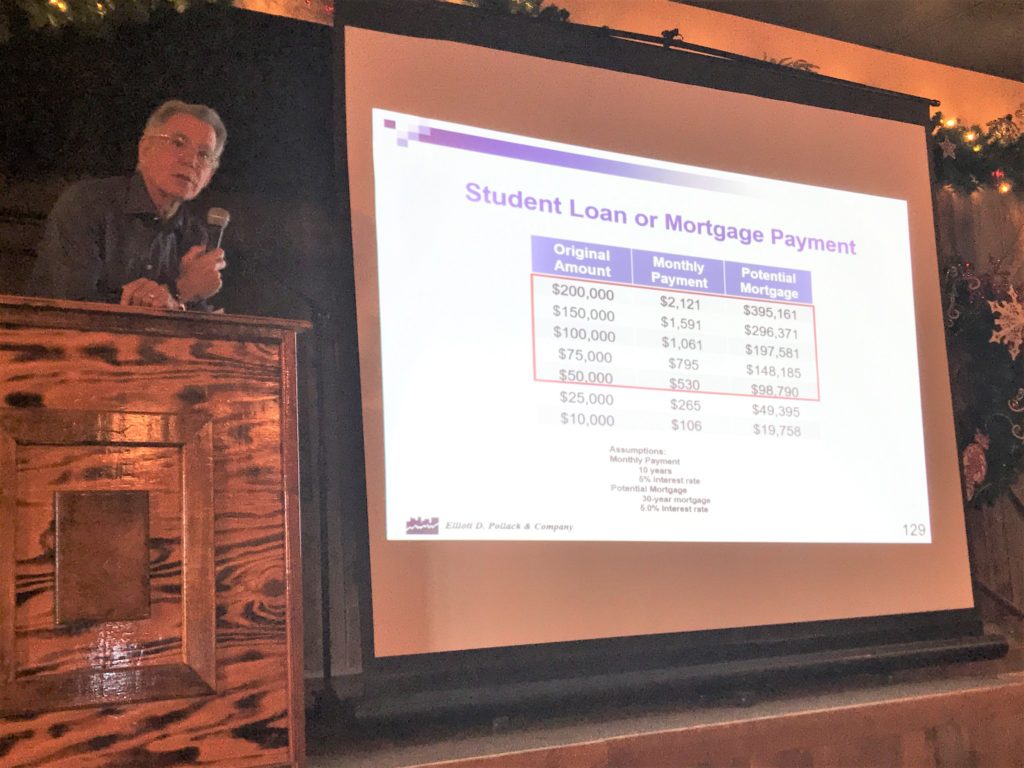

Another positive for hosing is millennials entering the market, as they recover and get past the effects of the Great Recession, where they were hit by multiple factors such as lack of jobs, substantial student debt and lack of purchase power.

Things that keep Pollack up at night are the seven million unfilled jobs in the U.S., 600,000 of which are tech jobs. Employment growth is growing more rapidly than there is labor force to fill the need that eventually turns into higher prices, which the worries the fed.

There are also increasing credit card and auto loans in delinquency.

Fluctuations in the stock market are an unknown at this point. There have been thirty-six stock market corrections since the end of World War II with only twelve predicting a recession that occurred.

Above all, Pollack’s message going into the new year was to enjoy, it’s going to be a good year.