|

|

||||||

|

||||||

Eloy plant producing renewable natural gas

By Michael Maresh | Eloy Enterprise ELOY — A company in Eloy is converting dairy manure into renewable natural gas through the utilization of a large digester. Eloy Circularity Center held a

|

|

||||||

|

||||||

By Michael Maresh | Eloy Enterprise ELOY — A company in Eloy is converting dairy manure into renewable natural gas through the utilization of a large digester. Eloy Circularity Center held a

(Disclosure: Rose Law Group Founder and President Jordan Rose is a member of the Barrow Neurological Foundation Board of Trustees and is co-chair of the

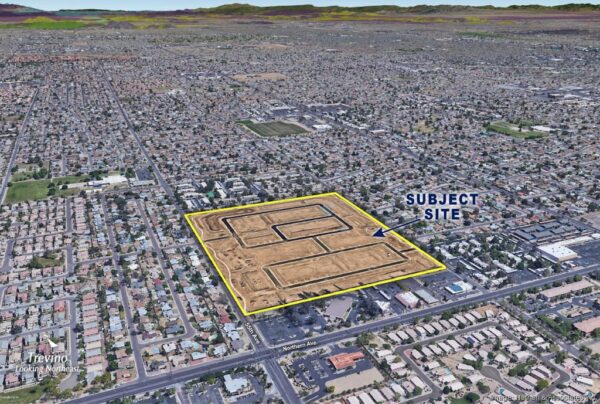

VIA NATHAN & ASSOCIATES INC. (Disclosure: Rose Law Group represents Richmond American Homes.) By Angela Gonzales | Phoenix Business Journal Richmond American Homes of Arizona Inc. plopped down

Rose Law Group pc values “outrageous client service.” We pride ourselves on hyper-responsiveness to our clients’ needs and an extraordinary record of success in achieving our clients’ goals. We know we get results and our list of outstanding clients speaks to the quality of our work.

(Photo via Gensler, Arizona Coyotes) By Arizona Sports | KTAR Despite the imminent sale and relocation of his team to Salt Lake City, Arizona Coyotes owner Alex Meruelo still plans to bid on and win the

By Angela Gonzales | Phoenix Business Journal A group of investors who own approximately 30,000 acres of land in the Harquahala Valley have inked a

By Jack Healy and Kellen Browning | New York Times Arizona’s highest court on Tuesday upheld an 1864 law that bans nearly all abortions, a decision that could

By Gene Marks | The Hill Have you heard of the Corporate Transparency Act? Apparently, it’s freaking people out. The law was passed as part of

By New York Times The Justice Department will reopen an antitrust investigation into the National Association of Realtors, an influential trade group that has held sway over the residential real estate industry

By MMJ Daily Rose Law Group has announced the return of Ryan Hurley, known as the “Father of Cannabis Law” in Arizona, according to the

Rose Law Group Reporter, which provides Dealmaker’s content and service, is contracted by Rose Law Group. Rose Law Group is a full service real estate and business Law Firm practicing in the areas of land use/entitlements, real estate transactions, real estate due diligence/project management, special districts, tax law, water law, business litigation, corporate formation, intellectual property, asset protection, data breach/privacy law, ADA compliance, estate planning, family law, cyber-law, online reputation and defamation, lobbying, energy and renewable energy, tax credits/financing, employment law, Native American law, equine law, DUIs, and medical marijuana, among others. The views expressed above are not necessarily those of Rose Law Group pc or its associates and are in no way legal advice. This blog should be used for informational purposes only. It does not create an attorney-client relationship with any reader and should not be construed as legal advice. If you need legal advice, please contact an attorney in your community who can assess the specifics of your situation.