ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

January 28th, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

On Friday, after more than four weeks, the partial shutdown of the U.S. government ended, at least temporarily. The agreement included a three-week spending bill that will pay federal workers the lost pay due to the shutdown. Hopefully, a more permanent agreement will be worked out over the next three weeks.

The impact of the shutdown was estimated to be about 1/10th of 1% of GDP growth per week during the shutdown period. This is due mainly to spending cutbacks on the part of government workers and contractors who did not get paid and the ripple effect of that lost spending. Estimates are that furloughed workers cut their spending by 10-20% during the period they did not receive their pay. They will get lump sum checks and much, but not all, of the reduction in consumption will ultimately have been delayed rather than a permanent spending reduction. So, the overall effect on GDP in the first quarter should be small assuming that the craziness ends here.

The psychological effect has already shown up even though most Americans were not directly impacted. Last week, consumer confidence fell substantially. Hopefully, a combination of the end of bad press over the shutdown combined with the more positive news about the stock market will allow confidence to rebound.

A lot of government data was also a victim of the shutdown. As a result, most of this week’s data is from private sources. The data paints a picture of an economy that is still moving forward but, not surprisingly, at a more moderate rate. Overall, neither the shutdown or the data suggest any change to the outlook for continued but more modest growth in 2019.

U.S. Snapshot:

-

Initial unemployment insurance claims reported last week were the lowest since November 15, 1969. There were 199,000 claims reported. The previous week’s number was 212,000.

-

The index of leading indicators declined 0.1% in December to 111.7 from 111.8 in November. The index increased 0.2% in November. The Conference Board memo that was released with the data stated, “While the effects of the government shutdown were not yet reflected here, the index suggests that the economy could decelerate towards 2% growth by the end of 2019.” Also, worth noting was that due to the government shutdown, information of manufacturers’ new orders for consumer goods and materials for November and December and building permits were not published for December. The Conference Board used its internal estimates for the index.

-

30-year fixed rate mortgage rates remained at 4.45% for the third week in a row for the week ending January 24.

-

According to the National Association of Realtors, existing home sales declined in December. This followed two months of gains. Sales of existing single family homes in December were 10.3% below year earlier levels. For 2018 as a whole, sales were down 3.1% from 2017. Median prices also declined in December. They were down 1.4% for the month but remain 2.9% above year earlier levels.

Arizona Snapshot:

-

Lodging performance remained strong in Arizona and Metro Phoenix in the 4th quarter. For the state as a whole, occupancy rates were 65.5%. That’s up from 63.5% a year ago. Demand was up 4.3% and supply was up 1.2% from a year ago. In Metro Phoenix, occupancy rates were 68.1%. That’s up from 66.4% a year ago. Demand was up 4.4% from year earlier levels and supply increase 1.7% over that period.

-

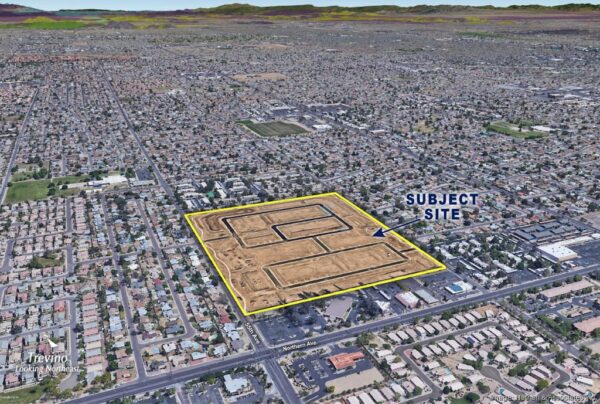

The Southern Arizona housing market continued to do well. New home permit volume grew by double digits for the third consecutive year. The summer months once again provided the highest volumes of the year as builders fulfilled orders from the spring selling season. In December, new home permits were flat compared to a year ago at 259 units. For 2018 as a whole, permits were up 11.0% to 3,495 units.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200