ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

February 19th, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

The latest economic news was reasonably positive. There was a rebound in consumer confidence reflecting the end of the partial government shutdown. Retail sales were up but weak in December. Consumer prices were just about where the FED had hoped. Industrial production, while down for the month in January, was still up over a year ago. And housing affordability held relatively steady on a national level.

In Arizona, housing affordability drifted downward in both Phoenix and Tucson. This reflected some moderation in mortgage rates combined with increases in home prices. And in Tucson, the number of home resales in January was about flat with year earlier levels while listings were down over that time period.

Let’s talk about the yield curve. The yield curve (specifically, the spread between the 10-year treasury and the 2-year treasury) has been flat for the last month. While many economists look at this relationship as a significant indicator of the economy’s outlook, the best correlation as an indicator of recession is the spread between the 10-year treasury rate and the 3-month treasury rate turning negative for more than a month. That has yet to happen in this cycle. Indeed, most treasury rates since the beginning of the year have been flat. This is good news for the economy.

After the last Fed Funds rate increase, the general expectation was that rate increases would continue. After the stock markets obvious dislike of that expectation, the FED has been more patient. And as long as inflation rates and employment costs remain under control, level rates are likely to continue.

Eventually, rates will rise. It’s part of the process the FED uses to keep the economy from overheating. By the way, it’s not only the cost of money that creates the environment for a slower growth rate (and usually an eventual recession), it is the availability of money. If banks and other financial intermediaries start to feel insecure, they will make it more difficult as well as more costly to borrow. While the FED controls short term rates, it does not as directly control availability. This is probably more psychological than economic.

Keep in mind that people tend to have short term economic memories. So, when the word recession comes up in today’s world, the knee jerk reaction is to think of 2007-2009. Not a happy experience. The good news is that most recessions are short and shallow rather than long and deep. That is likely to be the case when the next recession does eventually show up. That day of reckoning is not likely to occur soon.

U.S. Snapshot:

-

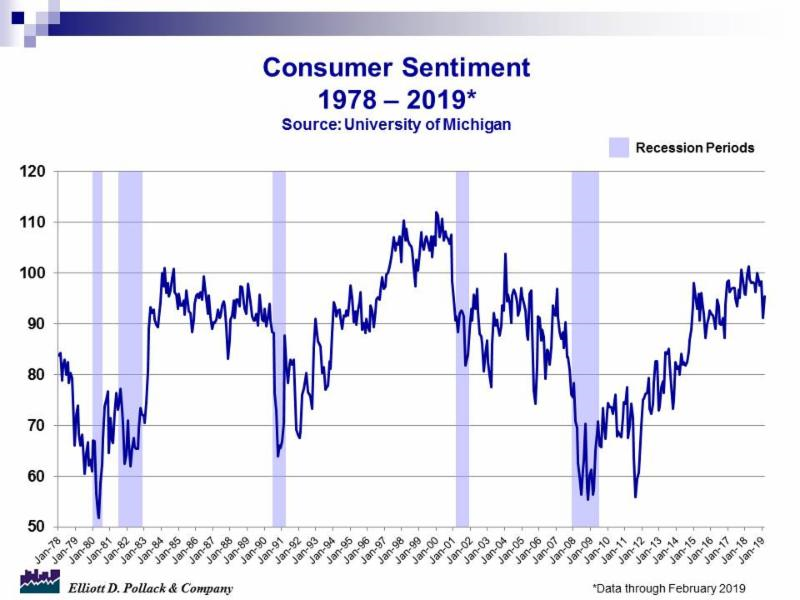

The University of Michigan Consumer Sentiment Index regained much of its January decline in early February. The gain reflects the end of the partial government shutdown as well as a more fundamental shift in consumer expectations due to the FED’s pause in raising interest rates. The index in early February stood at 95.5 compared to 91.2 in January and 99.7 a year ago (see chart below).

-

Consumer prices as measured by the consumer price index for all urban consumers (CPI-U) were unchanged in January when compared to December and were up 1.5% from year earlier levels. The index for all items less food and energy (the base rate of inflation) was up 0.2% for the month and was up 2.1% from year earlier levels. This is in line with expectations.

-

Retail and food service sales for December declined 1.2% from November and stood 2.3% ahead of year earlier levels. This was below expectations.

-

Total manufacturing and trade sales in the U.S. were down slightly in November (0.34%) but were up 4.2% from year earlier levels.

-

Industrial production was down 0.6% in January when compared to December. It was up 3.8% from year earlier levels.

-

Housing affordability as measured by the NAHB/Wells Fargo housing opportunity index improved modestly in the 4th quarter of 2018. The index increased to 56.6 in the 4th quarter. In the 3rd quarter, the index stood at 56.4 and a year ago the index was at 59.6. A modest increase in interest rates offset a slight decline in home prices in the quarter. The index means that 56.6% of new and existing homes sold between the beginning of October and the end of December were affordable to families earning the U.S. median income of $71,900. Builders are finding it increasingly difficult to build at price points most consumers need because they are struggling with burdensome regulations, higher material costs and shortages of lots and labor.

Arizona Snapshot:

- The NAHB/Wells Fargo housing opportunity index for both Phoenix and Tucson fell in the 4th quarter. The index for Greater Phoenix stood at 56.1 in the 4th quarter compared to 56.6 in the 3rd quarter of 2018 and 63.1 a year ago. In Greater Tucson, the index fell to 65.1 in the 4th quarter compared to 66.7 in the 3rd quarter and 72.7 a year ago. The declines were due to higher prices and higher mortgage rates.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200