ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

April 1st, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

The exciting news this week was political rather than economic. Since this is not a political document, we will be the only publication you have read lately that doesn’t comment on the Mueller report.

That being said, the economy continues to do almost exactly what we have come to expect. It continues to move forward but with more mixed news than earlier in the cycle. Last week we found out that the 4th quarter was weaker than previously expected. Given all the noise that occurred in the quarter (government closing, etc.) this is no surprise and does not change the general economic picture. The new figure is based on more complete data than the previous numbers and is, therefore, more accurate.

There were positives. Inflation as measured by the GDP deflator is remains under control. Both total personal income and disposable personal income are increasing faster than the CPI. Mortgage rates continue to decline and are now the lowest since early 2018. And while new home permits were modestly down over a year ago, they were down less so than last month. Also, new home sales were up and consumer confidence, while mixed (one of the two most followed measures increased), was still at high levels.

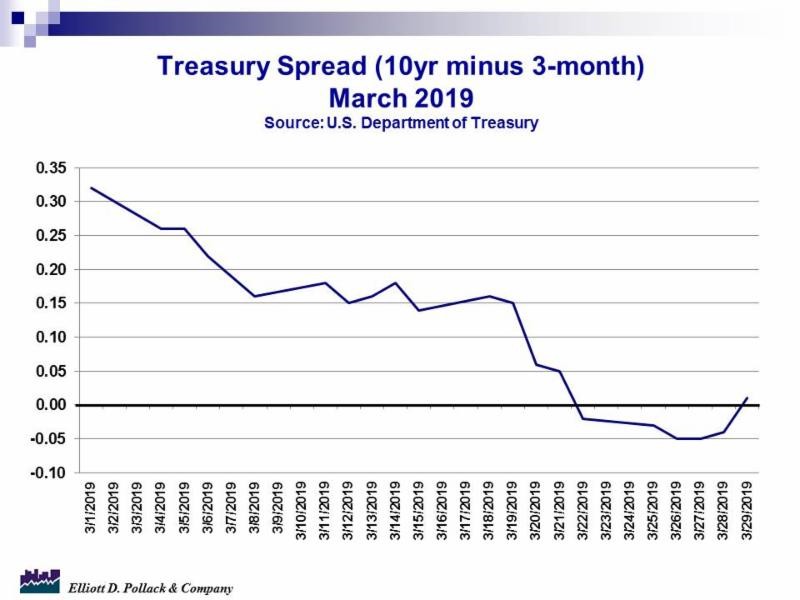

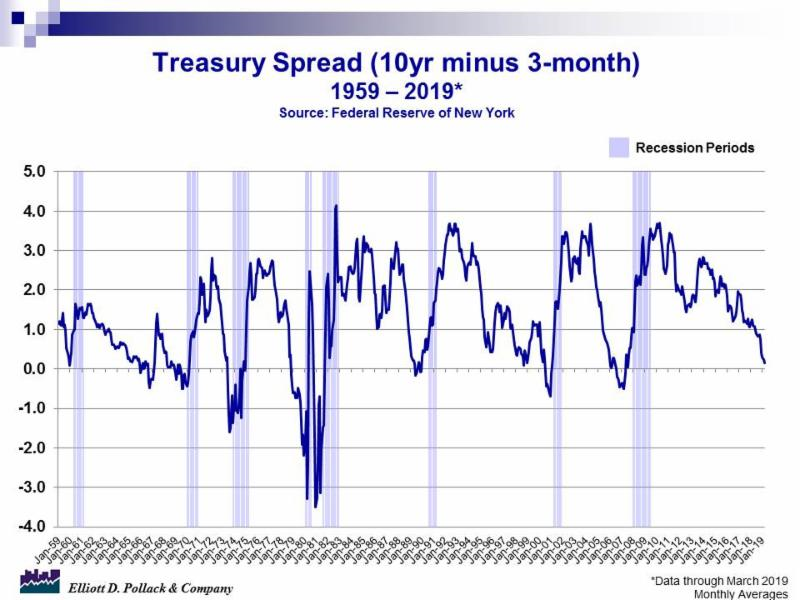

Finally, the yield curve (as measured by 10-year notes less 3 month bills) was modestly negative for the week. It’s still too early to get concerned (see charts below).

U.S. Snapshot:

Real gross domestic product (GDP) increased at an annual rate of 2.2% in the 4th quarter of 2018. In the 3rd quarter, real GDP increased at a 3.4% annual rate. The initial estimate had real GDP up at a 2.6% annual rate. The new estimate is based on more compete data.

Personal income is up 0.2% over January and 4.2% over last year. Disposable income is up 4.3% from a year ago.

While consumer confidence has been choppy over the last few months because of the partial government shutdown, financial volatility and signs of an international slowdown, confidence remains at high levels. Despite this, confidence fell unexpectedly in March from 131.4 to 124.1. Most of the decline is due to feelings about present conditions. This drop should not be reason for concern especially since the University of Michigan measure of consumer feelings rose over the same period and both remain at high levels.

Privately owned housing permits in February were at a seasonally adjusted 1,296,000. This is 1.6% below the revised January level of 1,317,000 and 2.0% below year earlier levels of 1,323,000. Single family units were permitted at a 821,000 rate. This is flat compared to January’s number and 7.3% below year earlier levels.

New home sales fared better. They were up 4.9% from January and 0.6% above year earlier levels.

30-year fixed rate mortgage rates were down to 4.06% on Friday. That’s down from 4.35% at the end of February and down from 4.94% in mid-November. That’s an 88 basis point drop. It was a surprise to most observers and significantly aids affordability.

The S&P/Case-Shiller 20-City Composites home price index for January was down 0.2% from December but up 3.6% above year earlier levels. Home price gains are clearly moderating.

Arizona Snapshot:

Enplanements at Sky Harbor were up 3.0% in February while deplanements were up 2.2%. Overall, traffic was up 2.6% for the month.

The S&P/Case-Shiller home price index for Greater Phoenix was down 0.1% in January but still up 7.5% from year earlier levels.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200