ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

June 17, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

While a few of the major indicators that turn negative before a recession have indeed turned, several others have not. So, the economy continues to move forward despite the negative headwinds of old age and trade war worries.

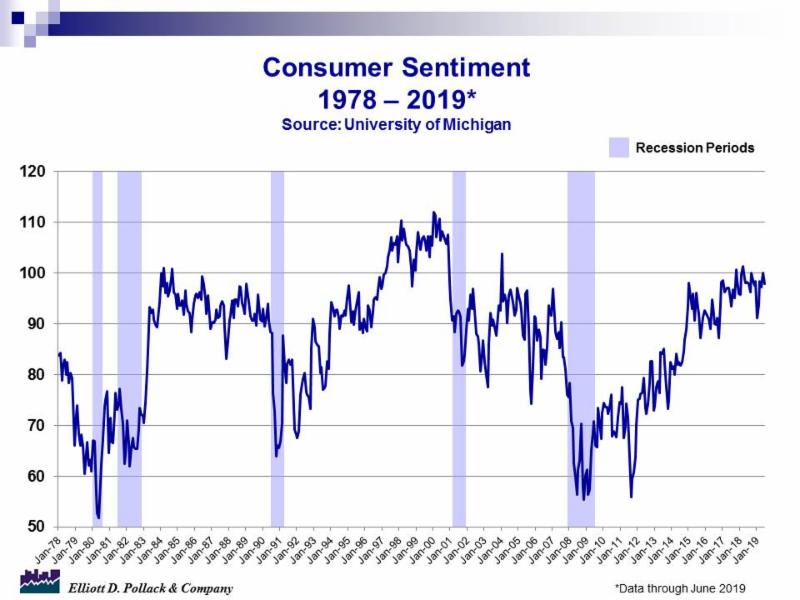

As we have said before, expansions don’t die of old age. They do start showing their age, however. This one is showing some significant wrinkles, but, is still ticking. The number of unfilled jobs in the country is still amazingly high. Consumer confidence, while off of its cyclical peak, remains high. Retail sales are moving forward. Manufacturing is crawling, but, at least it’s crawling in the right direction. Consumer prices are in the range desired by the FED. And industrial production remains at high levels. So far, so good.

As for Arizona, last week’s news was about housing in Greater Tucson. MLS listings for all home types in Tucson were down from a year ago while sales were up. The median price of homes sold were well above year earlier and month ago levels. It is a strong market.

U.S. Snapshot:

In April, there were 7,449,000 job openings in the country. This is marginally down from the 7,484,000 openings in March but well above the 7,106,000 unfilled jobs of a year ago. Labor markets are still very tight and employers are having trouble filling positions.

The University of Michigan consumer sentiment index in June dropped from May’s 100.0 to 97.9 (see chart below). A year ago, the index stood at 98.2. Still, the index stands at a very high level. Given all the news about tariffs over the last few weeks, this is good news.

Retail sales in May were up 0.5% over April and were up 3.2% over year earlier levels. This is a good performance.

Total manufacturing sales in April were down a modest 0.2% from April but were still up 2.8% from a year ago.

The consumer price index for all urban consumers was up 0.1% in May compared to April. It now stands 1.8% over a year ago. The index for all items less food and energy was also up 0.1% for the month but was up 2.0% over year earlier levels. This is in line with the FED’s target.

Industrial production in May was up 0.4% from April and stood 2.0% above year earlier levels.

Arizona Snapshot:

According to the Greater Tucson multiple listing service the total number of listings in the Greater Tucson area declined to 2,705 in May. This compares to 2,900 in April and 3,048 a year ago. On the other hand, total sales in May were 1,671 compared to 1,537 in April and 1,581 year ago.

As one would generally expect with higher demand and lower supply, prices for housing rose. Median prices for homes of all types in Greater Tucson rose to $232,000 in May compared to $216,500 a year ago.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200