ELLIOTT D. POLLACK

& Company

FOR IMMEDIATE RELEASE

December 2, 2019

The Monday Morning Quarterback

A quick analysis of important economic data released over the last week

It was a short week for economic data. The government was closed on both Thanksgiving and Black Friday. But, there were some important pieces of information. Third quarter real GDP was revised upward. Though it was not dramatically higher, the revisions still show more strength than originally reported. Also, the Consumer Confidence Index remained at high levels and validated last week’s strong Consumer Sentiment reading. Personal income was disappointing but was still up at a rate higher than inflation and new employment. And consumers continued to spend. New home sales, while essentially unchanged from the last two months, are at a three-month average not seen this high in 12 years.

Given a supply constrained housing market, this is good news. In addition, housing prices are now growing at about the rate of inflation. This is about normal for home price increases in the long run. And probably the best news was that durable goods orders excluding transportation were up for the month and were only fractionally down from a year ago.

As for Arizona, activity at Sky Harbor continues to expand and housing prices in Phoenix are increasing more rapidly than in any other major market in the country. That’s actually not good news. It shows a continued and significant supply/demand imbalance and will not help with affordability going forward. In good news for housing, permits remain high and at the present time affordability is about at the long run average.

U.S. Snapshot:

Third quarter real GDP was revised upward from 1.9% to 2.1%. Consumer spending remained a growth leader despite posting slower growth than in the second quarter. Inventory investment turned to a minor support to growth and the drag from trade shrank from the second quarter. Government contribution declined. Real disposable income improved to 2.9% and the savings rate increased. Overall, the economy grew near its 2% growth potential.

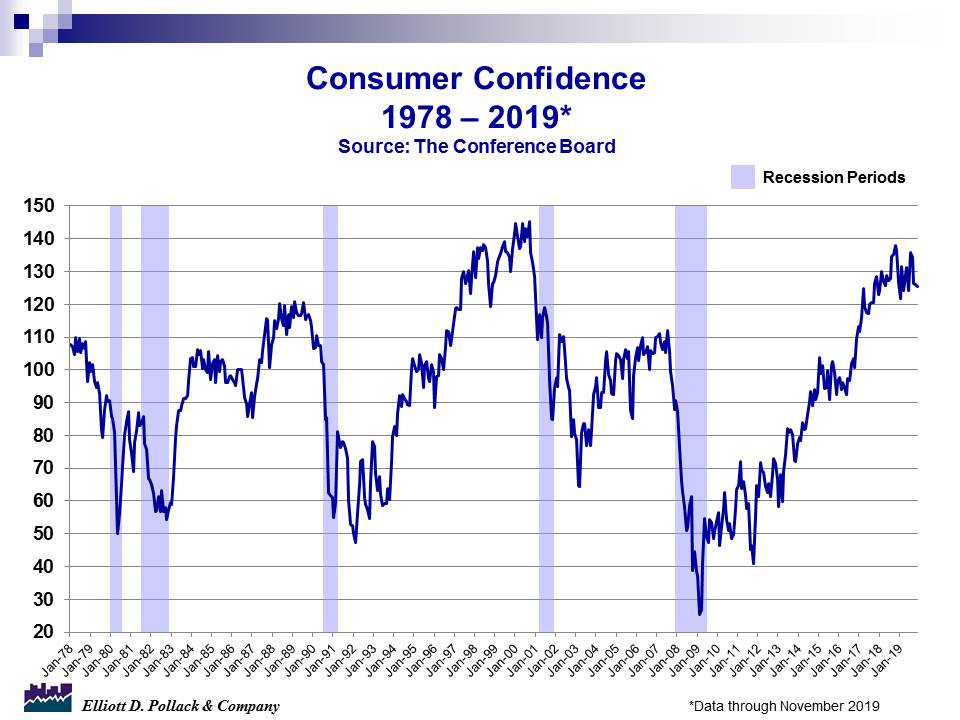

The Conference Board’s Consumer Confidence Index declined by a small amount in November. The index stood at 125.5 compared to 126.1 in October and 136.4 a year ago. The index is still at a high level (see chart below).

Personal income was disappointing. It was flat in October compared to September. But, it is still 4.4% above a year ago. The good news is that most of the growth came from compensation of employees. This was largely offset by losses in the more volatile categories of proprietor’s income and receipts on assets. Disposable personal income was also nearly flat while personal consumption expenditures were up 0.3%. Thus, consumers continue to spend. This is good news going into the holiday sales season.

Durable goods orders were up 0.6% for the month. This is better than expected. This increase, up four out of the last five months, followed a 1.4% decline in September.

The NAR pending home sales index retreated modestly in October to 106.7 compared to 108.6 in September and 102.2 a year ago.

New home sales declined slightly to 733,000 in October from 738,000 in September. The three month average is now the highest in 12 years. While the lack of inventory is still a problem nationally, these numbers are a positive if they continue into the spring sales season.

The S&P/Case-Shiller home price index has now slowed to about the level of inflation. This index is about the level that home prices mimic over the long run. The September index was 2.1% above year-earlier levels. In August, the increase was 2.0%. A year ago, prices were going up at a 5.1% rate.

Arizona Snapshot:

Total activity at Sky Harbor International Airport increased 3.2% in October from a year ago. This is down from the whopping 6.5% we saw last month. Year-to-date, total activity is up 2.7% in 2019.

According to S&P/Case-Shiller, housing prices in Greater Phoenix continue to grow at a faster rate than any other metro in the index. This indicates a continued and significant supply/demand imbalance. While September’s year over year growth of 6.0% is slightly below August’s 6.3%, it is significantly higher than the composite-20 at 2.1% and the nation at 3.2%.

About EDPCo

Elliott D. Pollack & Company (EDPCo) offers a broad range of economic and real estate consulting services backed by one of the most comprehensive databases found in the nation. This information makes it possible for the firm to conduct economic forecasting, develop economic impact studies and prepare demographic analyses and forecasts. Econometric modeling and economic development analysis and planning are also part of our capabilities. EDPCo staff includes professionals with backgrounds in economics, urban planning, financial analysis, real estate development and government. These professionals serve a broad client base of both public and private sector entities that range from school districts and utility companies to law firms and real estate developers.

For more information, contact –

Elliott D. Pollack & company

7505 East Sixth Avenue, Suite 100

Scottsdale, Arizona 85251

480-423-9200