By Fan-Yu Kuo | Eye On Housing

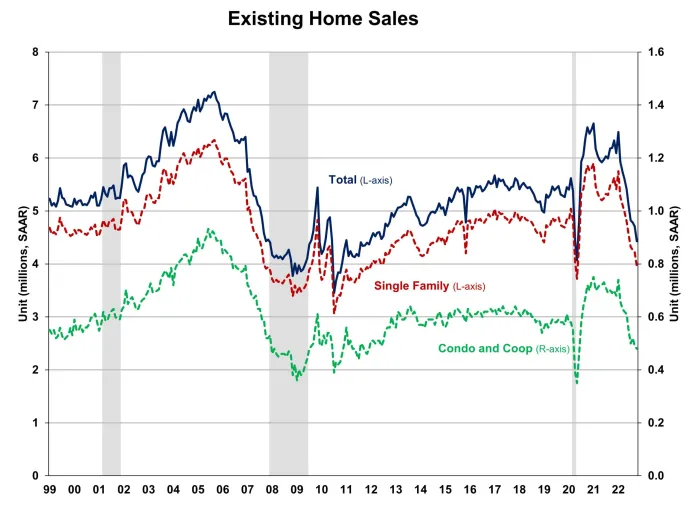

As higher mortgage rates continue to weaken housing demand, the volume of existing home sales has declined for nine consecutive months as of October, according to the National Association of Realtors (NAR). This is the longest run of declines since 1999. The average 30-year fixed mortgage interest rate increased from 3.11% at the start of the year to 6.61% this week, making housing less affordable.

However, home price appreciation slowed for the fourth month after reaching a record high of $413,800 in June.

Total existing home sales, including single-family homes, townhomes, condominiums and co-ops, fell 5.9% to a seasonally adjusted annual rate of 4.43 million in October, the lowest pace since December 2011 with the exception of April and May 2020. On a year-over-year basis, sales were 28.4% lower than a year ago.

The first-time buyer share stayed at 28% in October, down from 29% in both September 2022 and October 2021. The October inventory level fell from 1.23 to 1.22 million units and was down from 1.23 million a year ago.

At the current sales rate, October unsold inventory sits at a 3.3-month supply, higher from 3.1-months last month and 2.4-months reading a year ago.