By Russ Wiles || The Arizona Republic

The failure of Silicon Valley Bank, the largest U.S. banking setback since Washington Mutual 15 years ago, could have ramifications in Arizona including possible layoffs, other personnel changes or a new bank to take over operations.

No such details are public yet, and federal regulators aren’t saying much.

While the technology startup-focused bank didn’t operate branches in Arizona, it maintained one of its largest offices near Tempe Town Lake, with several hundred employees.

The company’s Arizona presence began in 2012 and expanded most recently in November 2019, when the company employed about 700 people in Tempe and said it would add around 300 within a few years. At a 190,000-square-foot facility in the Hayden Ferry office complex at 80 E. Rio Salado Parkway, the company houses finance, information technology, and other corporate and operational functions. The bank’s name is on the building, part of the Tempe skyline.

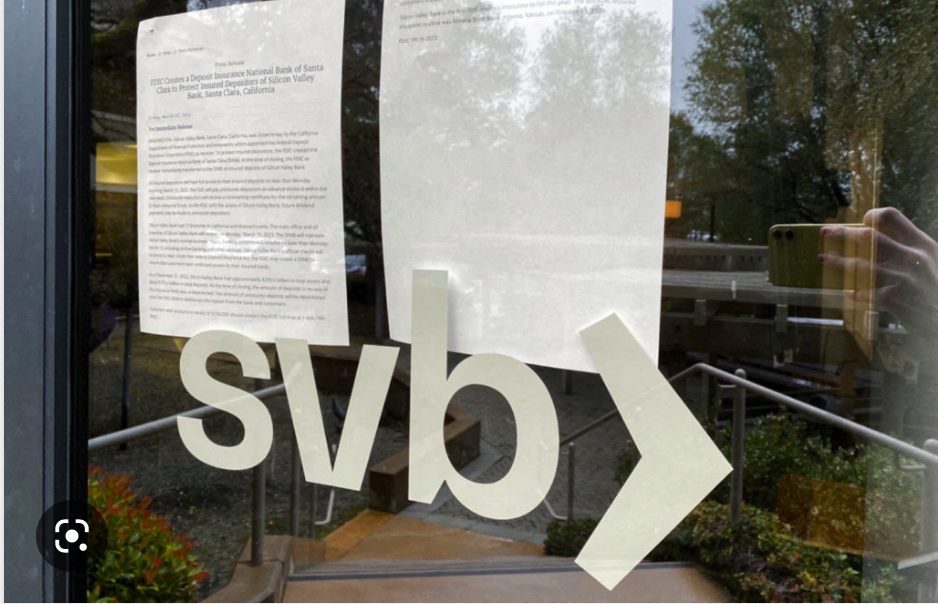

Parent SVB Financial Group is headquartered in Santa Clara, California. The corporation continues to provide private banking, venture capital and investment services but no longer owns the bank, the nation’s 16th largest, which was given the temporary name of Deposit Insurance National Bank of Santa Clara, under the control of the Federal Deposit Insurance Corp., or FDIC.

The FDIC didn’t respond to questions about the Tempe operation. Bank officials and representatives of economic development groups didn’t comment or couldn’t be reached.

Before the seizure of Silicon Valley Bank by California banking regulators and FDIC officials Friday, parent SVB Financial counted around 8,500 global employees, roughly 6,800 of whom were based in the United States. SVB employees earned median compensation of nearly $119,800 last year, though SVB Financial didn’t break that down to the Tempe office or other locations. The company has advertised for jobs in Tempe and other locations.

The bank’s 17 branches were located in California and Massachusetts, the FDIC said. It was the first bank closure by the FDIC since October 2020.