By Ali Wolf | Builder

Homeownership has traditionally been considered a key component of the “American dream.”

In fact, 98% of millennials want to become a homeowner at some point if they aren’t already, according to Zonda’s 6th annual millennial survey of more than 1,000 respondents across the country.

Millennials are the largest living generation in the U.S., and their decision to buy (or not) is the biggest potential tailwind (or headwind) to housing demand over the next few years.

Historically, the older the individual, the higher the homeownership rate. The trends we are seeing for millennials are no exception. Those younger than 35 have a homeownership rate of 39.3%, with that level reaching 62.5% for those 35 to 44, according to the U.S. Census Bureau. It is also not surprising that the homeownership rate is higher in more affordable housing markets across the country compared with more expensive ones.

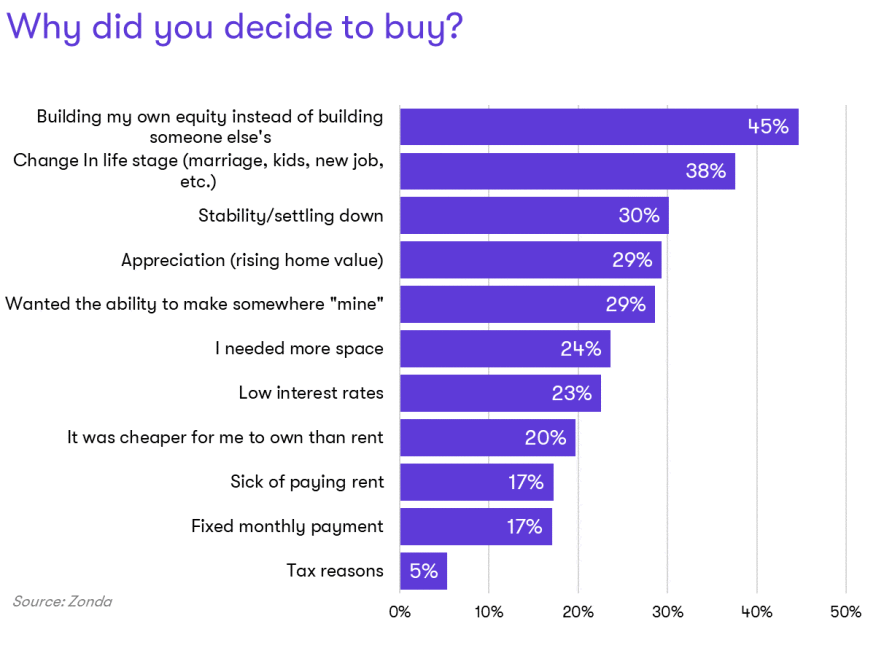

With this in mind, we think it is important to understand why millennials end up buying but also why some are still renting. We turned to our survey for answers.

1. Building equity. Housing as an investment was the No. 1 reason why millennials reported they decided to buy. Building up equity can allow for wealth accumulation and enable generational transfer of wealth down the road. The idea of “paying yourself” instead of a landlord is an attractive selling proposition.

2. Change in life stage. The average American age for marriage was 30.4 for men and 28.6 for women as of 2021. Further, the median age for childbirth was 30. These numbers correspond well with the median millennial age of 32 today. Demographics alone offer reasons to be bullish about housing in the medium term.

3. Stability/settling down. As this cohort ages, many aspire to the same things prior generations wanted. For example, millennials noted stability/settling down as their third key reason behind their purchase. If you combined this response with the No. 5 reason of them wanting to make somewhere “theirs,” then stability would be the top reason why millennials decided to purchase a home.