Photo via CoStar, Transwestern

By Paul Maryniak | SanTan Sun News

Despite gloomy – and in some cases, alarming – forecasts of a meltdown in the commercial real estate market, the Valley is nowhere near Armageddon, according to a recent report by a major player in that arena.

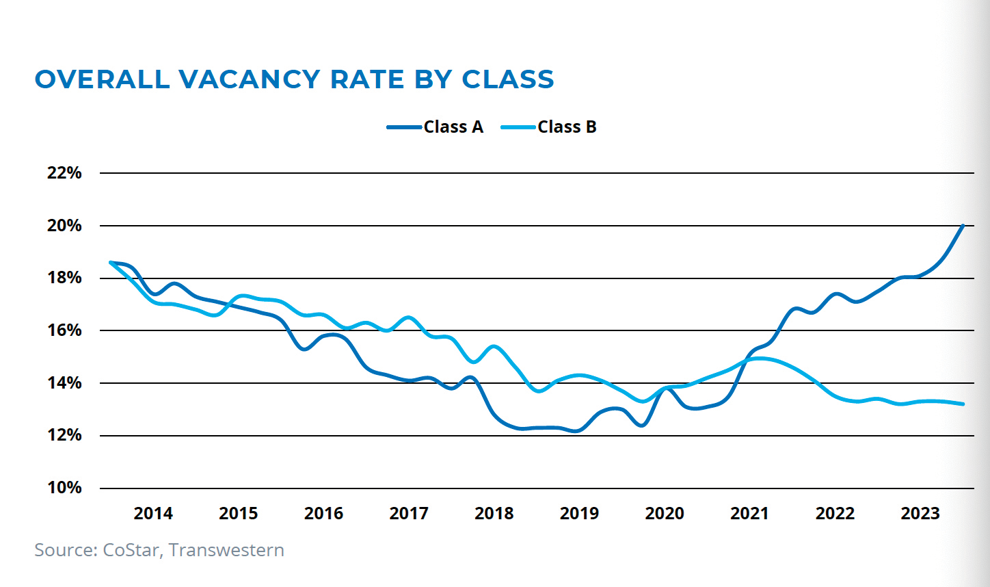

But some signs of distress appeared in Transwestern Real Estate Services’ report on third quarter performance in the Valley’s office market.

“Buyers and sellers continue to be at odds on pricing, with neither side wanting to make concessions to get deals over the finish line,” Transwestern said. “With tighter lending and unfriendly interest rates, investment activity continued to be incredibly stifled in Q3.”

Deals are still being made for office buildings in the Valley – most recently last week in Scottsdale, where Providence Real Estate Group paid $26.5 million to New York Life Insurance for a 141,534-square-foot office building, according to Valley real estate tracker vizzda.com. The three-story property, on just under 7 acres, was built in 2004.

“The good news in Phoenix is that we are not yet seeing the distressed sales that every doomsday foreteller has been prognosticating for the past 18 months,” Transwestern said.

Doomsday predictions have flooded national media for the last six months as office space continues to take a beating because so many workers continue to work at home – and resist their employers’ requests to return.

However, commercial real estate investment company CRBE reported in August that “Two-thirds of all U.S. office buildings were more than 90% leased as of Q2 2023 – not far off from the 71% of all office buildings in pre-pandemic Q1 2020.